THE PAYROLL THAT BROKE THE SYSTEM

JFS Workers, Administrative Raises, and the Point Lorain County Can No Longer Avoid

By Aaron Christopher Knapp, BSSW, LSW, CDCA(p)

Investigative Journalist | Founder, Unplugged with Knapp

Knapp Unplugged Media LLC

INTRODUCTION

The Record Is No Longer Quiet

For weeks, the situation inside Lorain County Job and Family Services has been framed as a contract dispute. It has been described as a negotiation between labor and management, a disagreement over wages, or a routine part of public sector bargaining. That framing narrows the issue. It suggests that what is happening now is temporary, contained, and specific to one department.

But the record does not support that view.

What is happening inside Job and Family Services is not an isolated event. It is the visible point of pressure in a system that has been building for years. It is the moment where a pattern that has existed in documents, budgets, and internal decisions becomes visible in the workforce itself.

Because public statements are not the record.

The record is something else entirely. It is not shaped by talking points or filtered through official explanations. It is the administrative history of what has actually been done. It exists in personnel agendas, payroll sheets, budget allocations, and internal documentation. It is reflected in hourly rates, classifications, approvals, and the brief justifications that accompany them. It is found in what is written, and just as importantly, in what is not explained at all.

When those records are reviewed over time, compared across departments, and placed next to one another, they begin to tell a story that does not depend on interpretation. It is a story reflected in numbers. It is a story of how compensation has been distributed, how discretion has been exercised, and how priorities have been set.

What those records show is not a single decision or a single contract dispute. They show a pattern. Administrative compensation has increased in ways that are measurable and documented, while frontline wages in departments responsible for delivering services remain compressed within lower ranges. The gap between those two realities is not theoretical. It is visible in the payroll itself.

This is not a question of opinion. It is arithmetic.

Under Ohio law, county commissioners are responsible for managing public funds and ensuring that county operations are sustained. At the same time, public employees have protected rights to negotiate wages and working conditions. Those two frameworks are meant to operate together. When they do not align, the result is not just disagreement. It is strain on the system itself.

That strain is now visible.

Because this is the point where the numbers leave the spreadsheet and begin to affect operations. When the employees responsible for administering public benefits begin to question whether they can continue to do that work under the current conditions, the issue is no longer abstract. It is no longer confined to policy discussions or internal meetings. It becomes a question of whether the system can continue to function as it is currently structured.

At that point, the record is no longer quiet.

At that point, the system is no longer being evaluated on what it says. It is being tested on what it has done.

THE PAYROLL EXPANSION THAT FORMED THE FOUNDATION

This is not a new issue. It is the continuation of a pattern that has been developing over time and can be traced through the county’s own financial and personnel records. What is happening now did not appear suddenly. It is the result of decisions that were made incrementally, documented in budgets, payroll reports, and personnel agendas that, when viewed individually, may appear routine, but when viewed together reveal a consistent direction.

In prior analysis of Lorain County finances, payroll data reflected a steady and measurable increase in overall labor costs. Total payroll rose significantly within a relatively short period of time. At the same time, the number of employees earning higher salaries expanded, particularly within administrative and non union classifications. These increases were not isolated adjustments. They were part of a broader trend that can be observed across multiple fiscal years.

Growth in payroll is not inherently unlawful, nor is it inherently problematic. Counties are expected to fund services, respond to changing demands, and maintain a workforce capable of carrying out public functions. Compensation will change over time as responsibilities evolve and costs rise. That is a normal aspect of government operations.

The issue is not whether payroll has increased. The issue is how that increase has been distributed.

When the data is examined in detail, the distribution of that growth becomes central. Increases have been concentrated in certain classifications, particularly in administrative and non union roles where compensation can be adjusted more readily. At the same time, positions that form the operational core of county services, including those responsible for direct interaction with the public, have remained within significantly lower wage ranges with far less flexibility for adjustment.

That distinction matters because it reflects more than budgetary change. It reflects prioritization. It shows where discretionary increases are being applied and where they are not. It shows how authority over compensation is being exercised within the structure of county government.

Over time, that distribution creates a widening gap between administrative compensation and frontline wages. That gap is not theoretical. It is measurable within the payroll itself. It is reflected in hourly rates, salary ranges, and the frequency and size of adjustments across departments.

When that pattern is sustained across multiple years, it stops being a series of individual decisions. It becomes a system.

And once it becomes a system, the analysis is no longer about any single raise or any single department. It is about whether the structure of compensation aligns with the operational needs of the county and the workforce required to meet those needs.

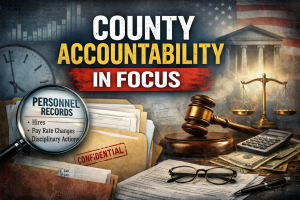

WHAT THE CURRENT PERSONNEL RECORDS SHOW

A Pattern Reflected in the County’s Own Documents

The personnel agendas approved by the Board of Commissioners do more than record routine administrative actions. When read carefully, they provide a detailed and verifiable account of how compensation decisions are being made within Lorain County government. These are not summaries or interpretations. They are official documents adopted in the course of public business, signed, certified, and preserved as part of the county’s administrative record.

Each agenda follows a consistent format. Employee names are listed alongside their departments, position types, and employment status. Current rates of pay are shown next to new rates. Wage ranges are included. An effective date is assigned. A rationale is provided. The documents are reviewed and signed by human resources and approved by the county administrator. These are not informal notes. They are formal actions.

When viewed one at a time, each entry appears ordinary. A hire. A rate change. A resignation. A promotion. The type of actions that occur in any government workforce. But when those agendas are examined collectively and over time, they begin to reveal a pattern that is both consistent and measurable.

Across multiple agendas, administrative and non union positions receive rate changes that are immediate and substantial. These are not limited to minor adjustments or standard increases tied to longevity. They move employees within higher pay bands, often approaching the upper end of the listed wage range. In some instances, the hourly rates shown in the record correspond to annual salaries that approach or exceed ninety thousand dollars.

At the same time, the rationale provided for those increases is often minimal. In multiple entries, the explanation for the change is reduced to a single word.

Merit.

That word appears repeatedly without further detail. The personnel agenda does not include the performance evaluations that support the designation. It does not include scoring criteria. It does not provide a comparative analysis showing how similarly situated employees were evaluated. The document reflects the outcome of the decision, but it does not reflect the process used to reach it.

This is not an isolated occurrence. It is a repeated feature of the record.

The same set of records shows general percentage increases applied to non union administrative positions, moving hourly wages upward within established pay bands. Those increases are often presented in uniform terms, without differentiation in the explanation beyond a generalized justification.

At the same time, the same records reflect entry level hires in other departments at substantially lower rates. Positions within Job and Family Services, including support and clerical roles, appear at starting wages that remain near the lower end of the overall compensation structure. Those figures are not estimates. They are recorded rates within the same administrative system.

The contrast is not abstract. It is documented within the same set of records, often within the same meeting agenda.

The personnel records also show how different types of actions are categorized. Rate changes, promotions, hires, and terminations are all processed through the same system. Disciplinary actions are recorded as well, and in those instances the rationale is often described with specificity, identifying the nature of the violation and the basis for the action taken.

That level of detail demonstrates that the system is capable of documenting reasoning when it chooses to do so.

Which makes the absence of detail in compensation decisions more significant, not less.

Because when discipline is explained in specific terms and compensation is explained in a single word, the difference is not the system’s capability. It is how that capability is being used.

The personnel agendas also contain language that reflects discretionary compensation structures within the commissioners’ office. In some instances, employees assigned to roles directly supporting the Board receive additional hourly compensation while in that assignment, with the increase removed when the assignment ends.

That structure ties compensation not solely to classification, but to assignment within the administrative hierarchy. It places the authority to adjust pay within internal decisions about roles and responsibilities that are themselves controlled by the same body approving the personnel actions.

Again, this is not hidden. It is written directly into the record.

When all of these elements are viewed together, the pattern becomes clear. The system is capable of detailed documentation. It records names, rates, ranges, and justifications. It distinguishes between union and non union positions. It tracks hires, promotions, and discipline.

But when it comes to explaining why certain employees receive significant increases in compensation, the public facing record often provides only a conclusion without the underlying basis.

And when that occurs repeatedly, across multiple agendas and multiple departments, the issue is no longer a single entry. It becomes a documented practice.

At that point, the question is no longer whether raises occurred. The records answer that.

The question becomes whether the process used to justify those raises is as clearly documented as the raises themselves.

That word appears in the record without accompanying documentation. There are no evaluation scores attached. There are no detailed explanations of how merit was measured. There is no comparative analysis showing how those determinations were made across departments or employees.

The record reflects the conclusion. It does not reflect the process.

That distinction is not technical. It is central to accountability.

DISCRETIONARY INCREASES TIED TO POSITION AND PROXIMITY

Another aspect of the personnel record requires closer attention because it reflects not just what decisions are being made, but how those decisions are structured.

Within the Board of Commissioners, certain positions receive additional compensation based on assignment rather than classification alone. The documentation reflects that individuals serving in roles directly supporting the Board President receive an additional hourly increase while performing that assignment, with the increase removed when the assignment ends. The compensation follows the role, not the position.

At first glance, that structure may appear administrative. It can be framed as a temporary adjustment tied to additional responsibilities. But the way the adjustment is applied matters. It places compensation within the control of internal assignment decisions rather than within a fixed and consistently applied classification system. The pay is not determined solely by job title, job description, or a standardized pay grade. It is tied to placement within the administrative structure itself.

That distinction is significant.

When compensation is tied to assignment, the authority to increase pay becomes directly connected to the authority to assign roles. In practical terms, that creates a system in which compensation can increase based on proximity to decision making authority. The closer an employee is positioned to the internal structure of leadership, the greater the potential for discretionary adjustments.

This type of system is not inherently unlawful. Public employers have flexibility in how they structure roles and assign duties. Temporary assignments, stipends, and adjustments tied to additional responsibilities are common across government. But the legality of the structure does not eliminate the need for clarity in how it is applied.

When discretion is concentrated, the need for defined criteria becomes more important, not less. There must be a clear and consistent framework for how assignments are made, how additional compensation is determined, and how similarly situated employees are treated. Without that framework, the decision making process becomes difficult to evaluate from the outside.

The personnel record reflects the outcome of these decisions. It shows the increase. It shows when it begins and when it ends. But it does not, on its face, explain the criteria used to determine who receives the assignment, how the additional compensation is calculated beyond a set figure, or how those decisions are applied consistently across the workforce.

That gap between outcome and explanation is where questions begin to arise.

Because when compensation can change based on internal assignment, and when the criteria for those assignments are not fully visible in the public record, the structure shifts from a fixed system to a discretionary one. And when discretion is exercised without clear, documented standards, the public is left with results that can be seen, but not fully understood.

In that context, the issue is not the existence of discretion. The issue is the absence of a clearly documented process that explains how that discretion is being used.

Without that clarity, the record reflects decisions, but not the reasoning behind them.

THE FRONTLINE REALITY AT JOB AND FAMILY SERVICES

While administrative compensation continues to rise within certain areas of county government, the same personnel records reflect a very different reality for the employees responsible for carrying out the day to day functions of public service. That contrast is not abstract. It is visible in the same documents, often within the same agenda.

Within Job and Family Services, employees responsible for administering public benefits are being hired at rates in the range of fourteen dollars per hour. That figure is not an estimate or an approximation. It appears directly in the personnel record as the approved rate of pay for positions tasked with processing applications, verifying eligibility, managing caseloads, and interacting directly with residents who rely on county assistance.

At full time hours, that rate translates to approximately thirty thousand dollars per year before taxes. When adjusted for basic living expenses, housing costs, and transportation, it represents a level of compensation that places significant financial strain on the employee.

These positions are not peripheral. They are not supplemental to the system. They are central to its operation. The employees in these roles are responsible for ensuring that benefits are distributed accurately, that applications are processed in compliance with state and federal requirements, and that individuals and families receive the assistance for which they qualify. Their work is not optional. It is required for the system to function.

Yet the compensation structure reflected in the record places these employees near the lower end of the overall wage scale within county government. In some cases, the wages are low enough that the employees themselves could meet eligibility thresholds for the very programs they administer. That is not a rhetorical point. It is a direct reflection of how the compensation structure aligns with the responsibilities of the position.

That alignment raises a broader question about the sustainability of the system.

When a government relies on employees to administer public assistance programs, but compensates those employees at a level that may require them to seek assistance themselves, the issue extends beyond wages. It becomes structural. It reflects how resources are allocated and how priorities are set within the organization.

Over time, that structure creates predictable outcomes. Recruitment becomes more difficult. Retention declines. Experienced employees leave for positions with higher compensation and lower workload. Those who remain carry increased caseloads, leading to further strain.

This is not a short term fluctuation. It is a condition that, if sustained, affects the stability of the entire system.

Because a system built on undercompensated labor is not resilient. It is dependent on the continued willingness of employees to absorb that imbalance. And when that willingness reaches its limit, the consequences are not confined to the workforce. They extend to the residents who rely on the services being provided.

At that point, the issue is no longer a matter of internal policy. It becomes a question of whether the system can continue to operate as designed under the conditions reflected in its own records.

THE SILENT LIABILITY OF COMPENSATORY TIME

There is another dimension to this issue that does not appear immediately in hourly wage figures or salary ranges, yet it carries both operational and financial consequences. That dimension is compensatory time.

Compensatory time represents hours that have been worked but not yet paid in wages. Instead of overtime compensation, those hours are banked as time that can be used later or paid out at a future date. In practical terms, it is labor that has already been performed, with compensation that has been deferred.

From an accounting perspective, compensatory time is not neutral. It is a liability. It represents an obligation that the county must eventually satisfy, either through paid time off or direct payout. While it may not appear as an immediate expenditure in payroll figures, it remains an outstanding cost that will have to be addressed.

The presence of comp time is not unusual. It is a common mechanism used in public employment to manage overtime within budget constraints. But the volume and consistency of comp time accrual are what matter.

When employees are regularly working beyond standard hours and accumulating comp time, it reflects a workload that exceeds available staffing. It indicates that the work required to maintain operations cannot be completed within the normal structure of the workforce. Employees are filling that gap by working additional hours, and those hours are being carried forward as a deferred obligation.

That creates a layered effect within the system. The work is being completed, but the cost is not being fully reflected in the present. It is being moved into the future.

Over time, those accumulated hours can become substantial. When they are eventually used or paid out, they can create operational gaps or financial pressures that were not visible in earlier budget cycles. In that sense, compensatory time functions as a delayed cost rather than an eliminated one.

There is also a human dimension to this structure. Comp time is not just a number on a ledger. It represents additional hours worked by employees who are already carrying the demands of their positions. In departments where wages are already compressed, the reliance on extended hours can compound the strain.

When lower wages are combined with sustained overtime demands, the result is predictable. Fatigue increases. Burnout becomes more likely. Employees begin to leave, not only because of compensation, but because of the cumulative effect of workload and deferred recovery time.

As employees leave, the workload does not decrease. It shifts to those who remain. Those employees, in turn, are required to work additional hours, which increases comp time balances and perpetuates the cycle.

This is how comp time moves from a management tool to a structural indicator.

When comp time balances grow, it can signal that the system is operating beyond its capacity. The work is still being completed, but it is being sustained through deferred compensation and extended labor rather than through adequate staffing and balanced workloads.

In that context, compensatory time is not just a technical detail within payroll. It is a measure of strain within the system itself.

And when that strain is combined with lower base wages in frontline departments, it becomes part of a broader pattern that affects both the workforce and the stability of the services being provided.

TURNOVER AND THE DRAIN ON THE SYSTEM

Administrative records, hiring notices, and personnel agendas reflect a pattern that extends beyond individual employment decisions. Positions are vacated, and those same positions are reposted. The cycle repeats. On its surface, that process can appear routine. In any organization, employees leave and new employees are hired. Movement within a workforce is expected.

But when that movement becomes consistent within specific departments, particularly those already operating at lower wage levels, it begins to reflect something more than normal attrition. It becomes a signal.

Turnover in that context is not simply the result of personal choice. It is often the result of conditions. Compensation, workload, and opportunity all play a role in whether an employee remains in a position. When wages remain low relative to the demands of the work, when workloads increase due to staffing shortages, and when opportunities for advancement are limited, the decision to leave becomes predictable rather than exceptional.

That pattern has consequences that extend beyond the individual employee.

Each departure represents a loss of institutional knowledge. Employees who have learned the processes, the requirements, and the complexities of their roles take that knowledge with them when they leave. New employees must be trained. That training requires time, supervision, and resources. During that period, productivity is reduced as new staff become familiar with the position.

At the same time, the work itself does not pause. Caseloads remain. Deadlines remain. Responsibilities remain. Those obligations are redistributed to the remaining staff, increasing their workload and, in many cases, extending their hours.

Over time, this creates a compounding effect. Increased workload contributes to burnout. Burnout contributes to additional departures. Each departure increases the strain on those who remain.

The financial impact of this cycle is not always reflected in the same way as payroll. While salaries may remain within a set range, the hidden costs accumulate. Training requires staff time. Delays can affect service delivery. Backlogs develop when work cannot be processed at the same rate. Errors become more likely when employees are overextended or inexperienced.

These are costs that do not always appear in a line item, but they are real. They affect both the efficiency of the department and the experience of the public relying on its services.

When turnover reaches a sustained level within a critical department, it becomes more than a staffing issue. It becomes an operational issue. The department continues to function, but it does so under increasing strain, relying on fewer experienced employees to carry a growing share of the workload.

At that point, turnover is no longer a background condition. It is part of the structure of the system itself.

THE MOMENT OF BREAKING

There are increasing indications that the current conditions within Job and Family Services are approaching a point where continued operation under the existing structure may no longer be sustainable. This is not a conclusion drawn from a single event or a single complaint. It is the result of patterns that have developed over time and are now converging.

When compensation remains low, workloads remain high, and turnover continues, the system does not fail immediately. It continues to operate, often through the effort of the employees who remain committed to their work. But that continued operation depends on a balance that cannot be maintained indefinitely. There is a point at which the strain placed on the workforce exceeds what can reasonably be absorbed.

When that point is reached, action follows.

That action does not always take a single form. It can begin with internal advocacy, where employees raise concerns through supervisory channels or administrative processes. It can move into formal grievance procedures, where those concerns are documented and addressed within the framework of labor agreements. It can also take the form of collective action, where employees act together to bring attention to conditions they believe are no longer acceptable.

Each of these steps represents an escalation. Each reflects a recognition that existing mechanisms have not produced a resolution sufficient to address the underlying issue.

If that escalation continues to the point where employees choose to withhold labor, even temporarily, the impact extends beyond the workforce itself. Job and Family Services is not a peripheral department. It is responsible for administering programs that affect a significant portion of the county’s residents.

When staffing levels are reduced, even for a short period, the effects are immediate. Benefit processing slows. Case management is delayed. Applications take longer to review. Communication with clients becomes more difficult. Residents who rely on those services experience the consequences directly.

This is not a hypothetical outcome. It is the natural result of reduced capacity within a system that operates on consistent processing and timely response.

The significance of that moment is not limited to the disruption it may cause. It reflects a broader condition within the system. It indicates that the balance between compensation, workload, and operational demand has shifted to a point where the workforce is no longer able to sustain it under existing conditions.

At that stage, the issue is no longer confined to internal discussions or policy considerations. It becomes visible in the operation of the system itself.

And when a system begins to show that level of strain, the question is no longer whether there is a problem. The question becomes how long the current structure can continue without change.

THE LEGAL AND PUBLIC ACCOUNTABILITY FRAMEWORK

Ohio law does not leave these issues to speculation or internal explanation. It provides a defined framework through which the public can examine how government decisions are made, how public funds are allocated, and whether those decisions are supported by a record that can withstand scrutiny.

At the center of that framework is Ohio Revised Code section 149.43, the Public Records Act. That statute is not limited to final decisions or summary reports. It applies to the underlying documentation that supports those decisions. Payroll records, personnel files, rate change justifications, performance evaluations, internal communications, and any documents that form the basis of a compensation decision are subject to disclosure unless a specific exemption applies.

The purpose of that statute is not simply to provide access to information. It is to ensure that the public can examine both the outcome and the process. A personnel agenda may show that a rate change occurred. The Public Records Act allows the public to ask what documents support that change, how the decision was made, and whether the same standards were applied consistently.

When a rate increase is justified as merit based, the expectation within a transparent system is that there is a record supporting that designation. That record may take the form of evaluations, scoring criteria, written assessments, or other documentation that demonstrates how merit was determined. If those records exist, they are subject to request. If they do not exist, that absence is not neutral. It becomes part of the record itself.

Ohio law also provides additional mechanisms for oversight. The Ohio Ethics Commission has authority under Ohio Revised Code Chapter 102 to review whether public officials have used their positions in a manner that results in improper benefit or conflicts of interest. The Auditor of State has authority under Ohio Revised Code Chapter 117 to examine the use of public funds, conduct audits, and, where appropriate, issue findings related to improper or unsupported expenditures.

These are not theoretical bodies. They are part of the structure designed to ensure that public authority is exercised within defined legal boundaries.

At the same time, labor relations within public employment are governed by Ohio Revised Code Chapter 4117. That framework recognizes the right of public employees to organize, to bargain collectively, and to pursue remedies when they believe that wages, hours, or conditions of employment are not being addressed in good faith. That system exists alongside the fiscal authority of county commissioners, creating a balance between management discretion and employee rights.

Taken together, these statutes form a comprehensive system of accountability. They recognize that public officials have discretion, but they also require that the exercise of that discretion be supported by a record that can be reviewed. They allow the public to examine not just what decisions were made, but how and why those decisions were reached.

That is where accountability resides.

It does not rest in statements or explanations alone. It rests in the ability to produce a record that demonstrates that decisions were made in a manner that is consistent, documented, and capable of being understood by the public that those decisions affect.

FINAL THOUGHT

THE RECORD WILL OUTLAST THE EXPLANATION

There is a tendency in public office to rely on explanation. Statements are issued. Decisions are defended. Narratives are constructed in meetings, in emails, and in public comment. The public is told what something means, why it was done, and how it should be understood.

But the record does not operate that way.

The record does not explain itself. It does not justify itself. It does not change based on how it is described. It exists independently of those explanations, fixed in the documents that were created at the time the decisions were made. It exists in the numbers, in the hourly rates, in the classifications, and in the limited justifications that accompany them. It exists in what is written, and just as importantly, in what is missing.

And in this case, the record did not come easily.

It had to be requested. It had to be clarified. It had to be pursued in a way that eliminated the ability to avoid the question. The initial request was straightforward. It sought personnel summary records, the documents that reflect hiring, firing, discipline, and rate of pay. Those records are not obscure. They are part of the routine operation of county government. They are created, maintained, and used in the ordinary course of business.

Yet even at that stage, the response began with uncertainty. There was language indicating that the existence of the records could not be guaranteed. That framing is not neutral. Under Ohio Revised Code section 149.43, the question of whether records exist is not a matter of speculation. It is a determination that must be made after a reasonable search. The law requires a clear answer. Either the records exist and must be produced, or they do not exist and that fact must be stated.

What the law does not contemplate is uncertainty as a standing position.

That is why the request had to be clarified. It had to be restated with precision, identifying not just the type of record, but every possible name under which those records might be maintained. Personnel summary sheets. Personnel action summaries. Rate change records. Disciplinary summaries. Authorization documents. Drafts. Approval sheets. Memoranda. Any record, regardless of title, that memorializes a personnel decision.

It had to define custodianship, making clear that the location of the record does not change its status as a public record. Whether held by the commissioners, the county administrator, human resources, payroll, or any employee acting on behalf of the board, the record remains subject to disclosure. Ohio law defines a public record by its function and use, not by the title of the person holding it.

It had to address redactions, requiring that any withheld information be supported by a specific statutory citation and a meaningful explanation, as required by law. It had to make clear that labels such as internal, draft, or predecisional do not remove a document from the scope of the Public Records Act when that document is used to conduct public business.

In other words, the request had to be structured in a way that removed every avenue for deflection.

And even then, the process was not immediate. There were clarifications. There were confirmations. There were acknowledgments that the records had been requested before and had been produced. There was an understanding that delay would occur.

Only after that process did the production come, with the statement that the request was fulfilled.

That process matters.

Because the difficulty of obtaining the record becomes part of the story. When records that reflect routine personnel actions require that level of precision and persistence to obtain, it raises a question about how accessible those records are to the public that is entitled to them. The law does not require perfection from a requester. It requires a public office to provide records promptly and within a reasonable period of time. It requires clarity in response, not hesitation.

The fact that these records required that level of effort to obtain does not diminish their significance. It reinforces it.

Because once obtained, the record speaks for itself.

It shows a system where administrative compensation has increased in measurable ways while frontline wages remain compressed. It shows discretionary decisions that are reflected in outcomes but not fully explained in the public record. It shows a structure that relies heavily on the employees who are paid the least, even as compensation at the top continues to expand.

Those conclusions are not based on statements. They are based on documents.

If the system continues to function, it will be because the workforce continues to carry it under those conditions. If it begins to break, it will not be because of a single decision or a single moment. It will be because of a pattern that has been building, documented in records that now exist outside of internal files and within public view.

That is the difference between explanation and record.

Explanations can change. They can be revised, reframed, or replaced.

The record does not.

It remains exactly what it was at the moment the decision was made.

And now that it has been obtained, it remains available for anyone willing to read it.

LEGAL DISCLAIMER

This publication is based on review of public records, including but not limited to personnel agendas, payroll documentation, and publicly available data obtained pursuant to Ohio Revised Code section 149.43. All factual statements are derived from those records to the extent available at the time of publication.

Any analysis or opinion expressed herein constitutes protected speech on matters of public concern and is offered for the purpose of public interest reporting, commentary, and investigation. Statements regarding potential misconduct are not findings of fact but reflect issues raised by the records and are presented for further public examination.

Readers are encouraged to review the underlying public documents and to reach their own conclusions.

TRADEMARK NOTICE

Knapp Unplugged Media LLC

Unplugged with Knapp

Lorain Politics Unplugged

All rights reserved.