Midway Mall and the Cost of Certainty

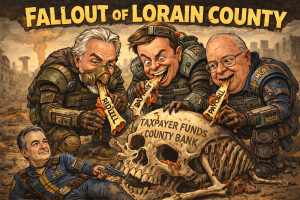

How a $13.9 Million “Transformational” Deal Became a Stress Test Lorain County Failed

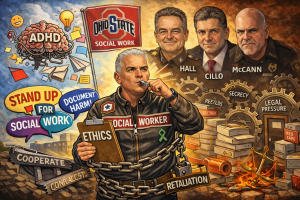

By Aaron Christopher Knapp, BSSW, LSW

Investigative Journalist and Government Accountability Reporter

Editor in Chief, Lorain Politics Unplugged

Licensed Social Worker

Public Records Litigant and Research Analyst

AaronKnappUnplugged.com

When Confidence Replaces Caution

For years, Lorain County residents were not merely encouraged to support the Midway Mall transaction. They were presented with a conclusion and asked to accept it as responsible governance. County leadership did not describe the acquisition as a speculative intervention in a collapsing retail sector. It was framed as transformational, disciplined, and necessary. The language was confident by design. It minimized uncertainty and emphasized inevitability. Midway Mall was portrayed not as a deteriorating commercial asset in a structurally failing market, but as a latent opportunity that merely required public initiative to unlock its value.

That framing was not neutral. It displaced the standard of care owed to taxpayers.

By the time Lorain County approved the Midway Mall loan, the decline of enclosed malls was no longer a debated economic trend. It was a settled market condition. Anchor tenants were abandoning properties nationwide. Foot traffic patterns had permanently shifted. Financing for mall redevelopment had tightened dramatically. Publicly available data showed that large scale mall turnarounds routinely failed even with private capital and favorable market conditions. None of this information was obscure, emerging, or speculative. It was known, documented, and widely understood.

“Proceeding under these conditions required restraint. What the County offered instead was confidence.”

That confidence has now collapsed. The redevelopment deal fell apart. The promised private follow through never materialized. The mall remains largely vacant. The County is left holding exposure without the outcome it sold to the public. What demands scrutiny now is not simply that the project failed. Failure is always possible. What matters is that the failure was foreseeable, that warning signs were visible before the loan was approved, and that County leadership chose to proceed anyway.

This is not a story about hindsight. It is a story about foresight that was disregarded.

Public Money Meets Private Speculation

In 2023, Lorain County approved a $13.9 million loan to the Lorain County Port Authority to acquire Midway Mall. With that vote, the County did more than endorse redevelopment in theory. It converted liquid public resources into a speculative real estate position tied to a property that had already demonstrated years of decline. This was not a passive role. The County underwrote the risk.

At the time, officials described the transaction as prudent and necessary. They spoke of stabilizing a blighted asset, preventing further deterioration, and positioning the site for redevelopment. What the public did not receive was the information fiduciary responsibility requires. There was no public demonstration that taxpayer exposure was capped. There were no binding redevelopment commitments from end users. There was no articulated exit strategy if private capital failed to appear.

“Confidence replaced contingency. That substitution was a choice.”

Midway Mall was not an unknown experiment. It was a known risk in a known market. Acquiring such a property without enforceable commitments or clearly defined downside protections was not a calculated gamble. It was an open ended assumption of risk where the public bore the downside and private participation remained optional.

County leadership proceeded anyway.

When the redevelopment plan collapsed, what should have followed was a pause and a public accounting. A clear explanation of why assumptions failed. A reassessment of whether the County’s redevelopment strategy was calibrated to manage speculative assets responsibly. None of that occurred.

Compounding Risk

From Midway Mall to the Condemned Days Inn

Rather than treating the failure of the Midway Mall redevelopment as a hard stop and a mandate to reassess, Lorain County leadership expanded exposure. The acquisition of the condemned Days Inn across the street did not precede the collapse of the mall plan. It followed it. It occurred while the County remained financially tethered to a largely vacant, nonperforming asset. And it occurred despite the fact that the Days Inn was already designated a nuisance property with foreseeable demolition, remediation, and carrying costs.

That sequence is not a coincidence. It is the central fact.

“This was not diversification. It was risk concentration.”

By proceeding under these conditions, County leadership chose to layer additional speculative risk on top of unresolved exposure. This reflects a sunk cost mindset where prior commitment becomes justification for further commitment rather than a signal to reassess.

At this point, the issue ceases to be judgment error and becomes fiduciary failure.

Fiduciary duty requires reasonable care, diligence, and restraint. It requires responding to warning signs when they appear. It requires limiting exposure when assumptions fail. When leadership continues to commit public funds to distressed assets after a speculative redevelopment bet has already failed, without first accounting for that failure, the duty of care is breached not by intent, but by disregard.

The Accountability Gap

This is where responsibility can no longer remain abstract. The decisions that produced a $13.9 million public loan, the collapse of a redevelopment plan, and the assumption of additional distressed risk were the result of affirmative votes by elected officials. Responsibility does not dissipate when a deal fails. It concentrates.

Lorain County Commissioners, this record belongs to you.

The public record does not reflect that risks were rigorously stress tested, bounded, or paired with enforceable safeguards. When failure arrived, there was no public reckoning. No explanation. No corrective discipline. Instead, exposure expanded.

“Failure without analysis is not learning. It is denial.”

Final Thought

This Was Documented Before It Failed

This reporting did not begin with Midway Mall. Long before this redevelopment collapsed, this publication documented how one time money was converted into permanent obligation, how risk was centralized through appointed authorities, and how public confidence was used to bridge gaps that should have been addressed with safeguards.

The Midway Mall loan fit that pattern at the moment it was approved. The Days Inn acquisition confirmed it. Readers have seen this posture before in the radio system conflict, in the megasite push, and in the move toward centralized sewer governance. In each case, confidence came first, consequences followed, and accountability arrived last.

“This was not bad luck. It was continuity.”

The County is not out of options. It is out of credibility. Credibility is rebuilt through discipline, not optimism. Until Lorain County confronts the decision making culture that made this failure predictable, every future promise will carry the weight of the last one.

Related Reporting

If you want the full record context and the prior reporting this article relies on, start with the Midway Mall investigation and then follow the radio dispute and litigation timeline through the filings and analysis already published.

Midway Mall and redevelopment exposure

Midway Mall and the Cost of Certainty

CCI and the radio conflict series

The CCI Lawsuit: How Secrecy and Mismanagement Brought Lorain County to the Brink

The Contradictor-in-Chief: Dave Moore’s 8/15 Performance and the Unraveling of the CCI Sabotage Narrative

A Filing the Lorain County Commissioners Did Not Want the Public to Read

Lorain County’s Five-Year Spiral

Disclaimers

Legal Disclaimer: This article is a journalistic and public interest analysis based on publicly discussed actions, statements, and documents. It is not legal advice.

Fair Comment Disclaimer: Statements of opinion are clearly framed as opinion based on disclosed facts. Corrections will be made if materially verified errors are demonstrated.

AI Use Disclosure: Drafting assistance tools were used for structural organization. All factual assertions are intended to be grounded in public records and linked reporting.

1 thought on “Midway Mall and the Cost of Certainty”