A Manufactured Headline Masquerading as Relief

Aaron Christopher Knapp, BSSW, LSW

Investigative Journalist, Government Accountability Reporter

Editor-in-Chief, Lorain Politics Unplugged

Licensed Social Worker (LSW)

Public Records Litigant & Research Analyst

AaronKnappUnplugged.com

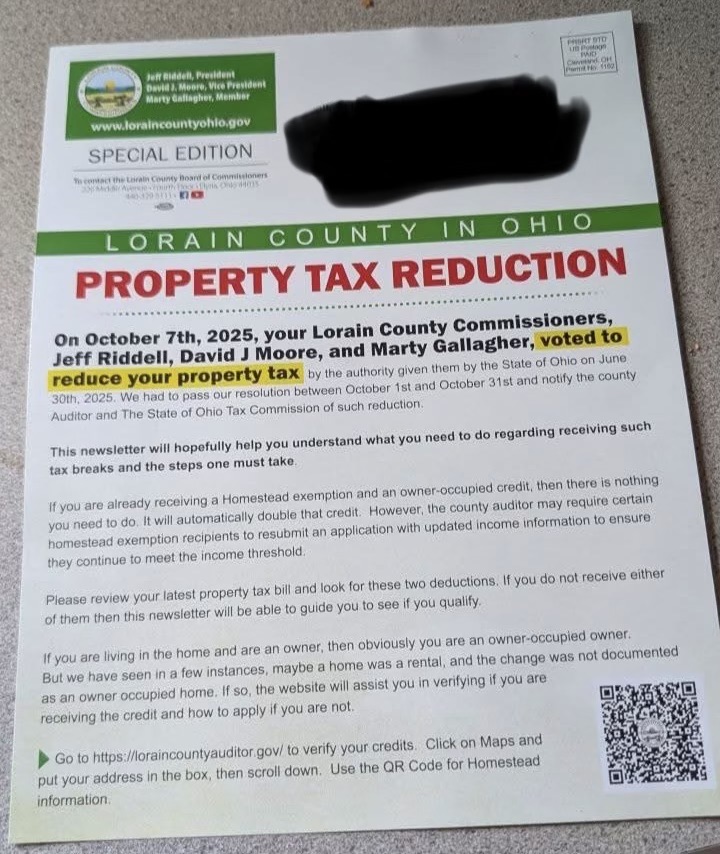

What arrived in mailboxes under the banner of a “Special Edition” was not news, not policy, and certainly not tax relief. It was a carefully staged piece of political theater designed to create the appearance of action where none occurred. The headline announces a “Property Tax Reduction,” yet the substance beneath it does not deliver any new reduction at all. Instead, it repackages long-standing state programs that predate the current board by years and presents them as if the commissioners had just unlocked something novel for residents. That is not governance. That is marketing paid for with public money.

The homestead exemption and the owner-occupied credit are not innovations of October 2025. They have existed for years under Ohio law. Eligibility rules, income thresholds, and application processes were already established. For the overwhelming majority of residents who qualify, enrollment already occurred long ago, and no action was required. Mailing a glossy notice to remind people of programs they are already using does not lower a single tax bill beyond what was already baked into statute.

What the Resolution Actually Did and Did Not Do

The newsletter leans heavily on the phrase “voted to reduce your property tax,” but the resolution itself does not create a new local reduction applicable to ordinary homeowners. There is no new credit crafted by the county, no rate change enacted by the commissioners, and no targeted relief for residents who do not qualify for homestead or owner occupancy. There is also no explanation of how a working household that falls outside those programs benefits in any way. The document never answers the most basic question residents should be asking. How does this reduce my tax bill if I am not already in one of these programs.

By omitting that answer, the publication relies on implication rather than substance. It allows readers to infer action without delivering measurable outcomes. That distinction matters, because public trust is built on clarity. When officials imply relief without providing it, the result is confusion at best and deception at worst.

The Cost of the Illusion

There is another problem that cannot be brushed aside, and it goes directly to the misuse of public funds. These mailers are not free. Countywide mailings of this size routinely cost tens of thousands of dollars, with estimates exceeding seventy thousand dollars for a single run. When similar publications are sent repeatedly over multiple years, the cumulative expense reaches well into the hundreds of thousands of dollars, if not more.

This is not money being spent to create new services, expand access, or address unmet needs. It is money spent to promote programs that already exist, programs that were already funded and already operating. The expenditure serves no functional purpose for residents who are already entitled to these services. Its real purpose is cosmetic. It creates the appearance of proactive governance while delivering nothing new.

That distinction matters. A legitimate public notice provides specific, time sensitive information that residents need in order to access a benefit or comply with a requirement. These mailers do not meet that standard. They are broad, glossy, and self congratulatory. They read more like campaign literature than public service announcements. The taxpayer is footing the bill for what is essentially a branding exercise.

Even more troubling is the implicit misrepresentation. By framing longstanding programs as recent accomplishments, the mailers suggest that current officials are responsible for services that predate them. Residents are being told, implicitly and sometimes explicitly, that their government has done something new on their behalf when, in reality, nothing has changed except the packaging.

At a time when officials publicly complain about budget pressures, staffing shortages, and the need for fiscal restraint, spending large sums on promotional mailers is indefensible. Every dollar used for optics is a dollar not used for direct services, employee retention, or genuine public need. It is especially difficult to justify when those same officials argue that they cannot afford other basic obligations.

This is not neutral communication. It is taxpayer funded promotion. Residents are paying to be reassured, not informed. They are paying to receive a narrative rather than a service. That should concern anyone who believes government spending should be transparent, restrained, and grounded in actual public benefit.

The cost of the illusion is not just financial. It erodes trust. When government uses public money to manufacture credit instead of deliver results, it teaches residents to doubt everything that comes after.

Context Matters and So Does the Pattern

This publication does not exist in isolation. It arrives in the middle of a long and well documented pattern of high dollar decisions that have strained county finances and weakened public confidence. Residents are not evaluating this mailer on its own merits. They are weighing it against a record that includes the failed Midway Mall transaction, expensive and controversial radio system decisions, and repeated attempts to reframe or minimize budget shortfalls after the fact.

Each of those episodes followed a similar trajectory. Large sums of public money were committed with assurances that the decisions were necessary, strategic, or fiscally responsible. When problems emerged, the response was not accountability or correction but messaging. Explanations were repackaged, timelines were rewritten, and responsibility was diffused. Over time, this pattern has created a credibility gap that no glossy publication can bridge.

Against that backdrop, claims that taxes have been “reduced” without any change to the underlying law invite immediate skepticism. That skepticism is not partisan and it is not cynical. It is the rational response of a public that has repeatedly been asked to trust narratives that later proved incomplete or misleading. When officials who have overseen tens of millions of dollars in disputed or failed expenditures suddenly announce financial relief that exists only on paper, residents are right to ask hard questions.

The contrast becomes even sharper when viewed alongside prior efforts to advance a quarter percent sales tax. That proposal was aggressively marketed as a measure to support public safety, particularly the sheriff’s office. Yet the actual structure of the measure allowed the funds to be redirected at the discretion of the commissioners. Nothing in the language guaranteed the money would remain locked to a specific department or purpose.

Voters recognized that distinction. What was presented as a targeted solution functioned in practice as a flexible revenue stream. The public rejection of that proposal was not a rejection of public safety but a rejection of vague promises and discretionary control. Residents understood that once new revenue entered the general fund, it could be shifted, delayed, or repurposed with little resistance.

When that context is taken seriously, the newsletter reads less like neutral information and more like damage control. It appears designed to reassure a public that has grown wary, to recast fiscal management in a favorable light without addressing the underlying decisions that created the skepticism in the first place. Rather than confronting past failures or clearly explaining present constraints, the publication leans on selective framing.

Context matters because patterns matter. When messaging repeatedly follows controversy, spending, or public pushback, residents learn to read between the lines. What might otherwise be dismissed as harmless promotion takes on a different meaning when viewed as part of an ongoing effort to manage perception rather than policy.

Who This Leaves Out

The most striking feature of this publication is not who it helps, but who it excludes. Large segments of the county’s population are left with no benefit, no explanation, and no acknowledgment that their circumstances even exist.

If you are a working homeowner who does not qualify for the homestead exemption and already receives the standard owner occupied credit, this publication offers nothing. Your tax bill does not change. Your costs do not go down. Yet you are still presented with language suggesting broad relief has been delivered on your behalf.

If you are a renter, the omission is even more pronounced. Rising property taxes are routinely passed through in the form of higher rent, yet renters receive no direct relief, no offset, and no discussion at all. The publication does not acknowledge pass through costs, housing pressure, or the reality that renters ultimately pay property taxes indirectly. They are simply invisible in the narrative.

If you are a homeowner just above income thresholds, you also fall into a blind spot. You may be on a fixed or limited income, partially disabled, or unable to work full time, yet still ineligible for homestead relief under current rules. The publication treats eligibility as binary. You either qualify and are counted, or you do not and are ignored. There is no recognition of those who fall into the gap between assistance programs and full earning capacity.

This is where the messaging becomes especially hollow. There is no roadmap for expanding eligibility. There is no discussion of advocating for legislative change at the state level. There is no county initiated proposal to adjust thresholds, modernize qualifications, or pursue alternative forms of relief for those who do not neatly fit existing categories. The silence on these points is not accidental. It avoids confronting the limits of what has actually been done.

Real leadership would start by explaining those limits honestly. It would acknowledge that counties cannot unilaterally change tax law, but that they can advocate, lobby, and propose reforms. It would outline what options exist at the state level, what conversations are being had, and what barriers remain. It would also be candid about what relief is not currently possible instead of implying that relief has already been delivered.

Instead, residents received a glossy affirmation that everything is being handled. The tone suggests resolution and progress, even as many residents experience the opposite reality when they open their monthly bills. For those left out, the message is not reassurance. It is erasure.

Accountability Is Not Extremism

Calling this out is not radical. Demanding honesty is not partisan. Accountability is a basic expectation in a functioning democracy, not an act of hostility or disruption. Asking whether public funds are being used to genuinely inform residents or to shape perception is not an attack on government. It is the role of an engaged public and a necessary check on power.

Accountability means separating policy from promotion. It requires distinguishing between decisions that materially change outcomes and communications that merely suggest progress. When taxpayer dollars are used to produce polished mailers that imply relief without delivering new policy, residents are justified in questioning intent. Transparency is not achieved by volume or presentation. It is achieved by clarity, accuracy, and context.

This scrutiny becomes even more important when communications blur the line between information and self credit. Government messaging should explain what exists, what has changed, and what has not. It should acknowledge limitations and avoid implying authority or accomplishments that do not exist. When that line is crossed, public trust erodes, even if the underlying programs themselves are legitimate.

Accountability also means remembering why elections exist. Commissioners are not insulated from criticism simply because they hold office. Public service does not confer immunity from evaluation. When residents believe their leaders are prioritizing optics over outcomes, the appropriate response is not silence, dismissal, or accusations of bad faith. It is scrutiny, public discussion, and ultimately participation at the ballot box. That process is not extremism. It is the foundation of democratic legitimacy.

No resident is obligated to accept a manufactured narrative simply because it arrives stamped with an official seal. Government credibility is not created through repetition or branding. It is earned through consistency between words and actions, restraint in self promotion, and respect for the public’s intelligence. Residents have every right to ask whether these communications serve the public interest or primarily serve the image of those currently in office.

Healthy governments welcome these questions because they understand that accountability strengthens institutions rather than weakening them. When officials respond defensively to reasonable scrutiny, it signals insecurity, not leadership. The public is not asking for perfection. It is asking for honesty, proportion, and substance.

A Final Word on Trust

Trust, once broken, is difficult to rebuild, and in Lorain County that trust has not been strained by a single controversy or an isolated misstep. It has been worn down by a pattern of decisions that were expensive, poorly justified, and ultimately unsuccessful. The recent purchase of the Days Inn, the woefully shortsighted Midway Mall acquisition, the collapse of the New Russia megasite proposal, and the ongoing CCI radio system debacle are not disconnected events. Together, they form a record that residents cannot reasonably be expected to ignore.

Each of these decisions was presented with confidence. Each was framed as forward thinking, necessary, or transformational. And each, in different ways, has failed to deliver on what was promised. The Mall purchase was marketed as an economic catalyst, yet it quickly became a symbol of unrealistic planning and misjudged risk. The New Russia megasite was touted as a major development opportunity, only to unravel under scrutiny and collapse without delivering tangible benefit. The Days Inn purchase raised immediate questions about necessity, valuation, and long term purpose that were never adequately answered. The CCI radio system issue has moved beyond accounting concerns and into the realm of real world consequences, where poor decisions are measured not just in dollars but in disruption and harm.

When viewed together, these actions have turned the current board into a punchline in conversations across the county, not because of ideology, but because of performance. Residents are no longer reacting to isolated mistakes. They are reacting to a pattern that suggests a troubling disconnect between decision making and outcomes.

Against that backdrop, sending expensive countywide mailers that blur the line between education and self promotion is not just ineffective. It is damaging. Claiming credit for programs that predate the current board does not inspire confidence. It signals an attempt to manufacture success rather than confront reality. Taxpayer dollars are being used to create the appearance of relief while the underlying financial and governance issues remain unresolved.

If the goal were truly to help residents, the focus would be different. It would be on transparent budgeting that clearly accounts for past failures. It would be on measurable tax relief that actually changes what people pay, not messaging that reframes existing law. It would be on honest explanations of what the county can and cannot control under state law, and on realistic discussions of what went wrong and how it will be prevented in the future.

This publication does none of that. It does not acknowledge the cumulative cost of failed projects. It does not explain how confidence was misplaced or why safeguards failed. It does not confront the gap between promises made and results delivered. Instead, it asks residents to applaud a shadow, to substitute presentation for performance, and to accept reassurance in place of accountability.

You are not obligated to do so.

That is my assessment, based on the facts presented and the record of actions taken. Others are free to disagree. But disagreement should be grounded in evidence, outcomes, and financial reality, not in headlines, branding, or taxpayer funded narratives designed to soften the impact of a deeply troubled record.

Trust will not be rebuilt by insisting it exists. It will be rebuilt only when actions change, when failures are acknowledged, and when communication reflects reality rather than attempting to overwrite it. Until then, skepticism is not hostility. It is the reasonable response of a public that has been asked too often to believe and too rarely to verify.

Legal Disclaimer

This article is published for informational and commentary purposes only. It reflects analysis, opinion, and interpretation based on publicly available information, official records, and documented governmental actions. Nothing contained herein should be construed as legal advice, a factual allegation of criminal conduct, or a definitive statement regarding the intent or motive of any individual, officeholder, or government entity.

All references to policies, expenditures, transactions, and governmental actions are discussed in the context of public governance, fiscal oversight, and matters of public concern. Readers are encouraged to independently review primary source materials, public records, and official documents and to draw their own conclusions.

Artificial Intelligence Use Disclosure

Portions of this article were drafted, edited, or refined with the assistance of artificial intelligence as a writing and editing tool. AI was used to improve clarity, organization, and readability. All substantive viewpoints, conclusions, and editorial judgments are those of the author and were reviewed prior to publication.

Artificial intelligence was not used to independently investigate facts, generate source material, or replace original analysis. Responsibility for the content rests solely with the author.