Lorain Treasurer Previews Online Income Tax Filing as Long Planned Modernization Takes Shape

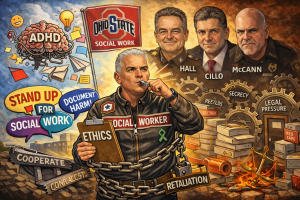

The accompanying image is an AI generated illustrative rendering created for visual context. It is not a photograph taken at the referenced meeting and should not be interpreted as an exact depiction of any specific moment or statement. The image is intended solely to provide a representative visual of a public official speaking in a public meeting setting.

By Aaron Knapp

Investigative Journalist and Editor, Lorain Politics Unplugged

Lorain City Treasurer Terri Soto announced during Tuesday night’s public meeting that the City of Lorain Income Tax Department is preparing to introduce online income tax filing this year. The statement was made in open session and reflects a modernization effort that has been in development for years rather than a short term or reactive change.

During the meeting, Soto stated that she hoped members of the press would request a press release so the information could be formally shared with residents once final details are ready. Although two local newspapers were not present, the announcement was made publicly and documented live, placing it squarely in the public record as the City prepares to move forward.

Planning That Began Under Prior Leadership

In a follow up interview after the meeting, Soto explained that offering online filing has been a long term professional goal dating back to her time working under former Mayor Chase Ritenauer. She described the initiative as the final item on her professional bucket list, one she has carried through multiple administrations and years of operational planning.

According to Soto, the extended timeline reflects the complexity of municipal tax administration and the need to ensure that any electronic filing system is accurate, secure, and compliant with Ohio’s municipal income tax framework. She emphasized that the goal has always been to improve service for residents while preserving the integrity of the City’s tax system.

Service Changes and Continued Access for Residents

Soto also addressed how the introduction of online filing is expected to affect day to day operations within the Income Tax Department. She stated that Saturday filing opportunities will still be offered as the filing season approaches, particularly during peak periods when residents traditionally seek in person assistance.

At the same time, she advised residents that they should expect a reduction in extended weekday hours. Soto explained that online filing will reduce the need for prolonged staffing schedules, producing savings that ultimately benefit taxpayers. The department’s approach, she said, is to maintain access while using public resources more efficiently.

What Has Not Changed Yet

As of now, online filing has not been posted on the City’s website, and no formal written announcement has been issued outlining launch dates or technical instructions. Soto encouraged residents to monitor the Treasurer and Income Tax Department webpage for an official announcement, which will provide clear guidance on when online filing becomes available and how it will operate.

She also reminded residents that until updated instructions are published, existing filing requirements remain in effect. The forthcoming announcement is expected to clarify how online filing will integrate with current payment systems and state mandated municipal income tax rules.

A Deliberate and Transparent Transition

City officials emphasized that the transition to online filing is being handled deliberately, with an emphasis on clarity, communication, and accountability. For residents, the key takeaway is that while filing procedures have not yet changed, a new option is forthcoming and will be formally announced before it takes effect.

Additional information will be released as it becomes available, and residents are encouraged to rely on official City postings for the most current and accurate guidance.

Use of AI generated illustrative images for news reporting and commentary is permitted under First Amendment principles and does not constitute misrepresentation when clearly disclosed. See, e.g., Hustler Magazine, Inc. v. Falwell, 485 U.S. 46 (1988) regarding protection of expressive content, and Ohio Revised Code Chapter 718 governing municipal income tax administration as referenced in the accompanying reporting. This image is used for informational and journalistic purposes only.

Aaron Knapp is an investigative journalist and editor of Lorain Politics Unplugged, an independent local accountability publication focused on government transparency, public records, and municipal governance in Lorain County, Ohio. His reporting centers on document driven analysis of public meetings, statutory compliance, and the actions of public officials, with an emphasis on making primary source information accessible to residents. Knapp regularly covers city council proceedings, fiscal policy, and administrative decision making, and his work is grounded in firsthand observation, recorded public records, and live meeting documentation.