The Payroll That Ate the Budget

A document driven Unplugged analysis of Lorain’s personnel spending from pre COVID through 2025, and what the numbers say when the talking stops

I am writing this because payroll is where government tells the truth. Not in speeches. Not in campaign mailers. Not in the word “priority.” Payroll is the receipt. Payroll is the part of the budget that does not pretend. It either goes up or it does not. It either concentrates at the top or it does not. It either crowds out everything else or it does not. And Lorain’s payroll record shows a story that is no longer subtle.

This is not a vibes piece. This is not “I feel like the city is spending too much.” This is a record based examination grounded in what the City’s own payroll output reports for calendar year 2025, what regional reporting documented about the 2024 spike, and what the Ohio Auditor of State’s forecast shows about the direction of police and fire wages and benefits during the COVID and post COVID years.

Before anyone tries to misquote this, I am not saying public employees do not work. I am not saying police and fire are not essential. I am saying the City has entered a payroll structure that appears to have reset to a new and higher baseline after COVID, and the City’s own auditor has warned, on the record, that spending patterns like this cannot continue indefinitely without consequences.

The One Number Lorain Cannot Talk Its Way Around

2025 gross payroll is already in black and white

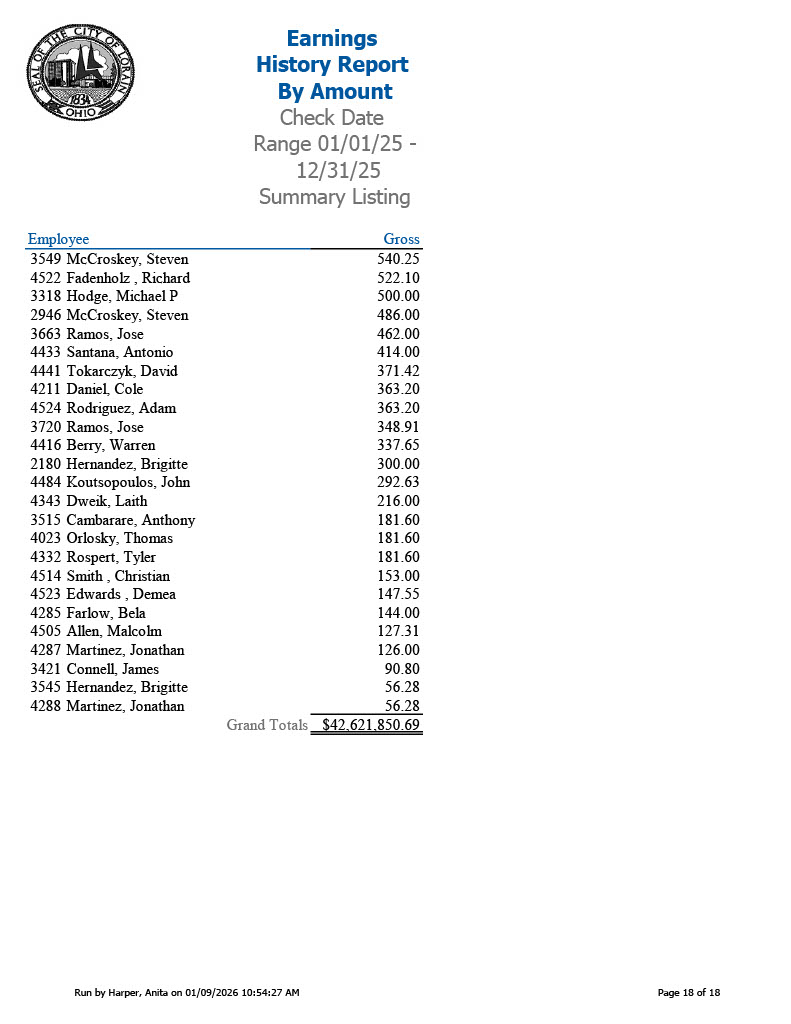

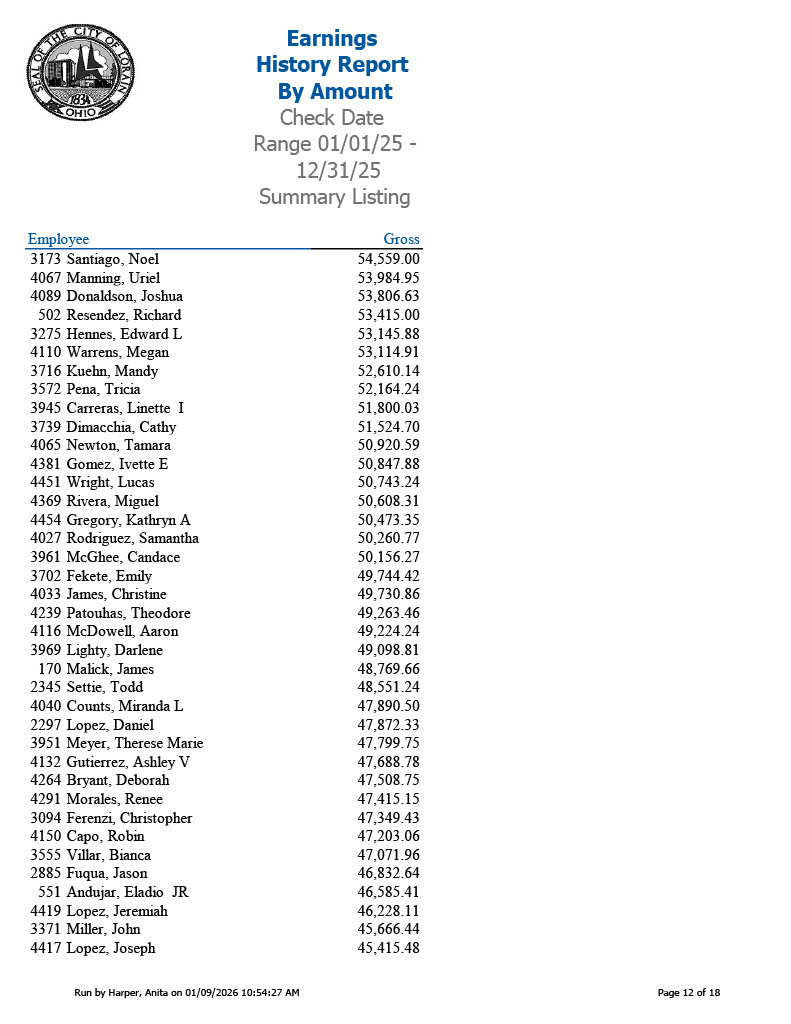

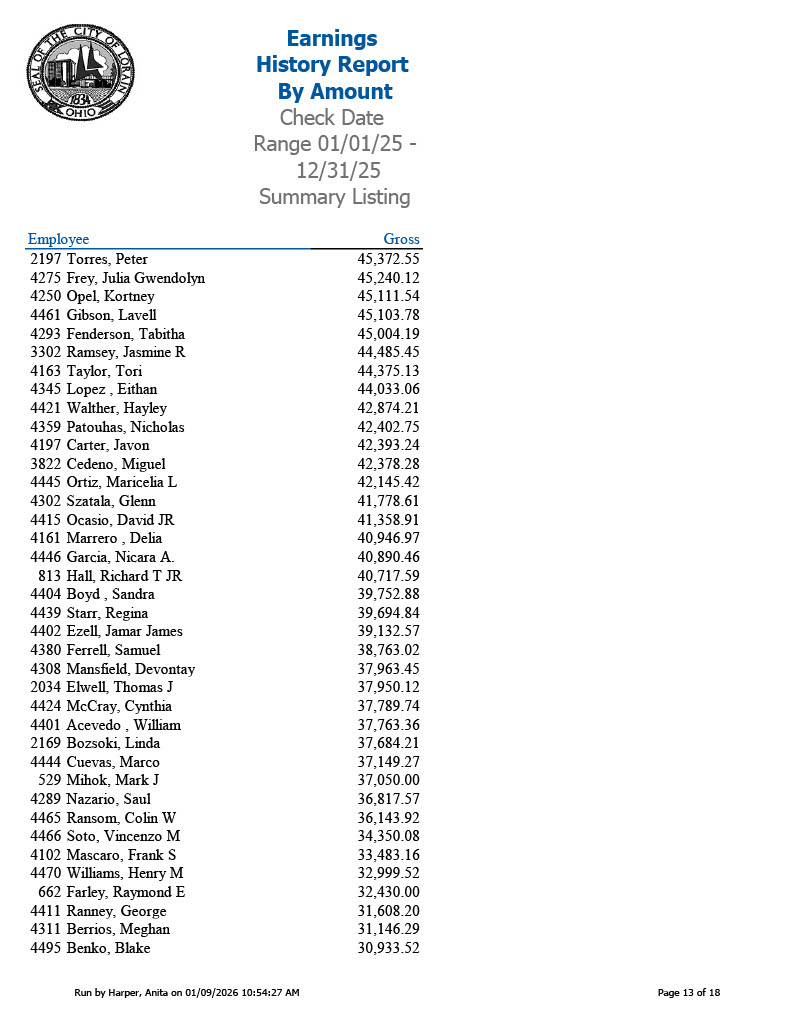

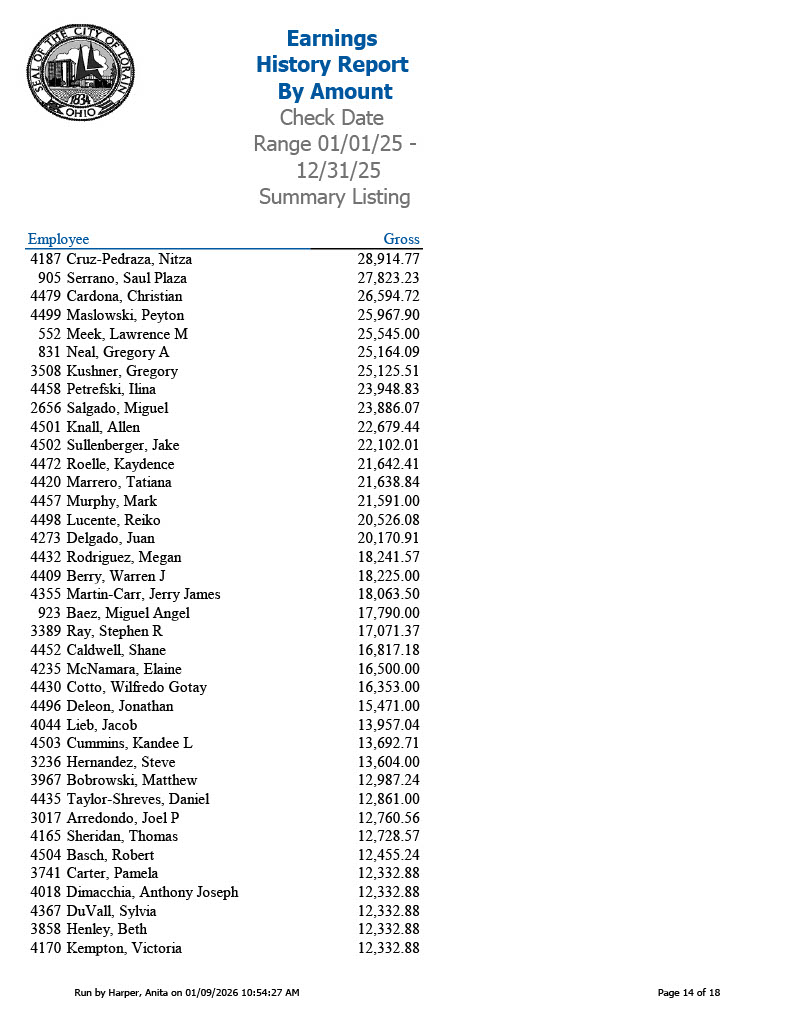

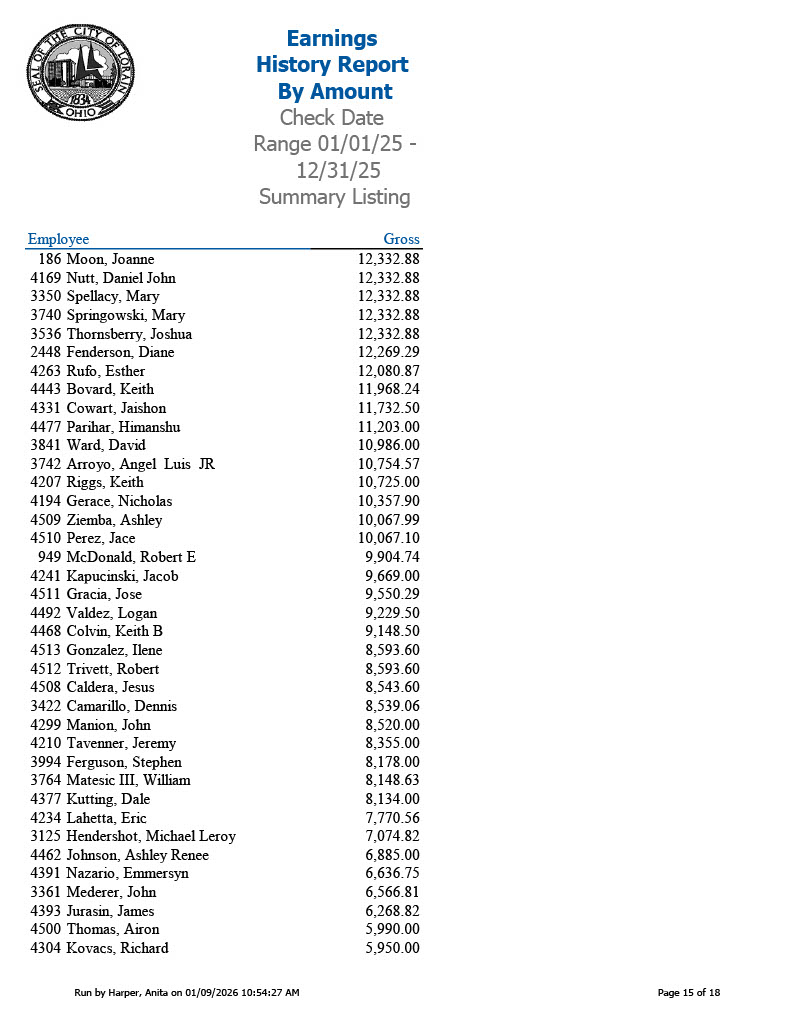

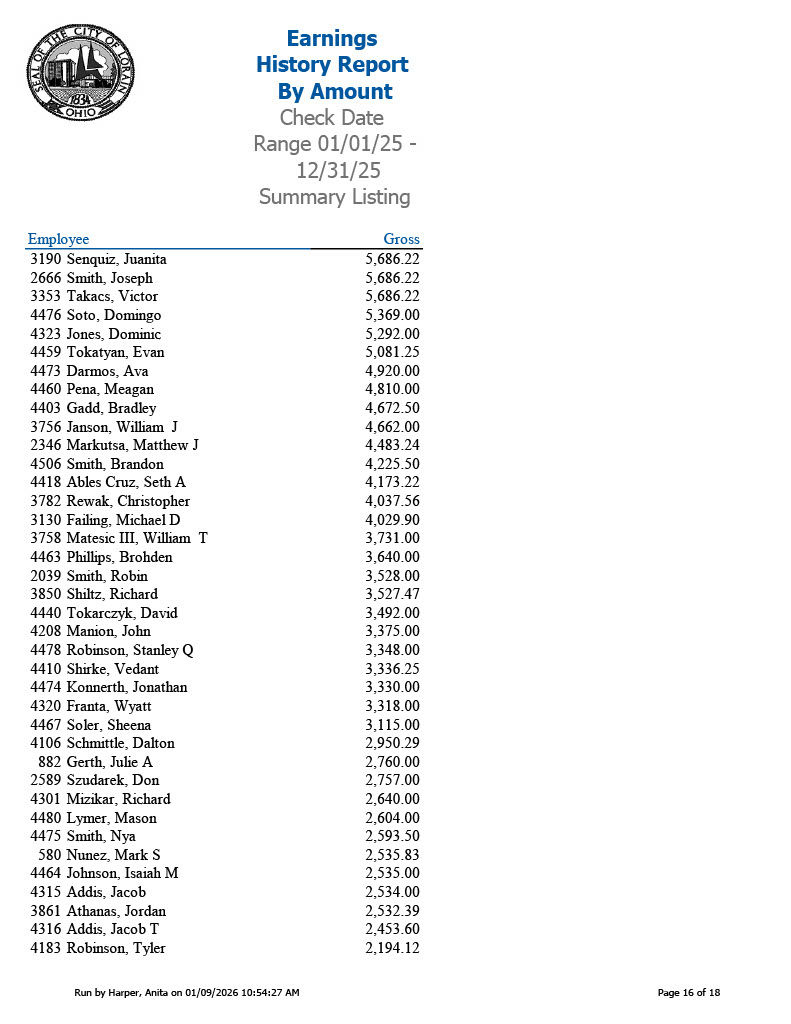

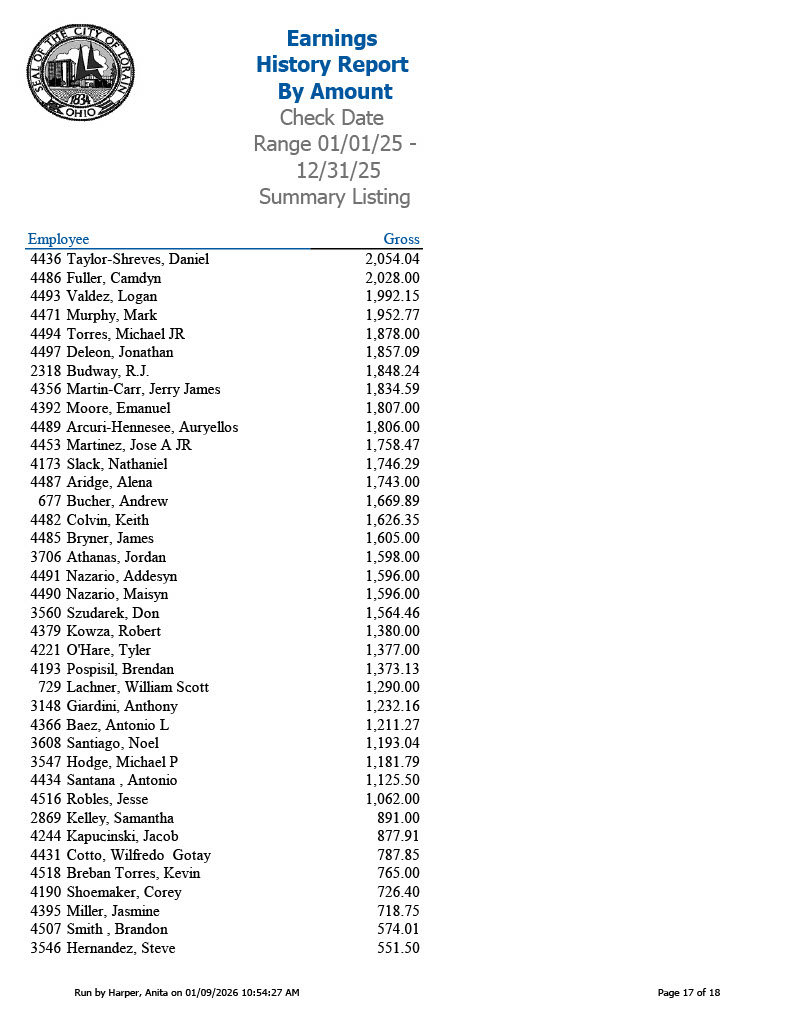

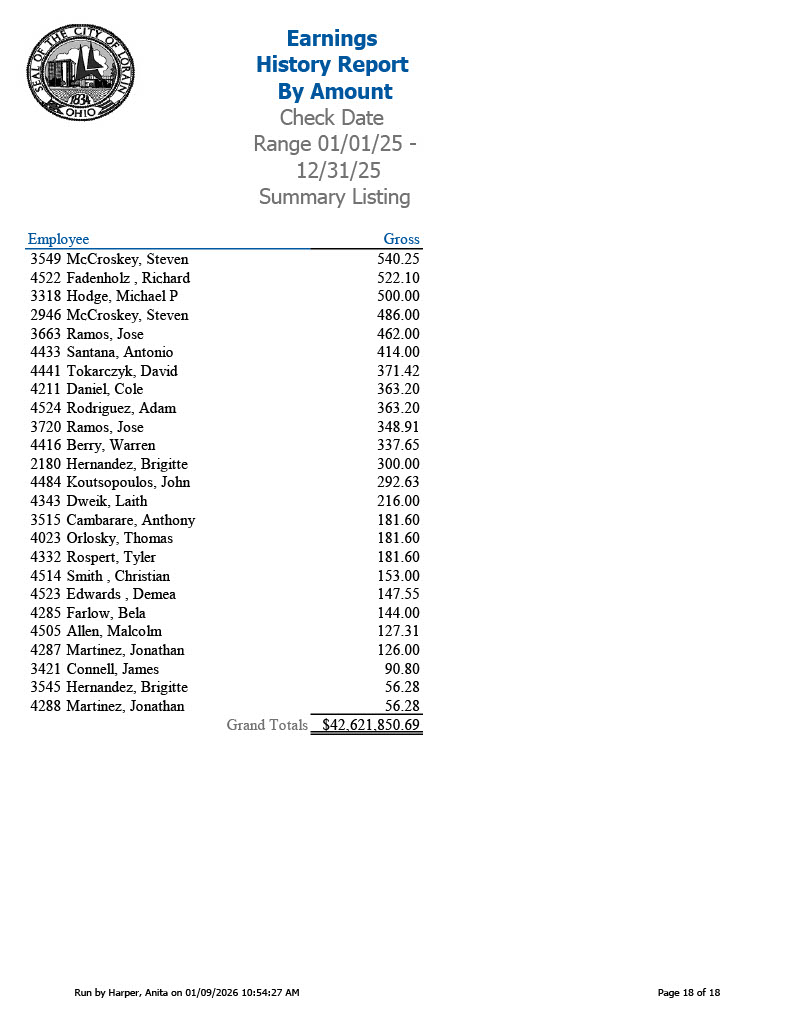

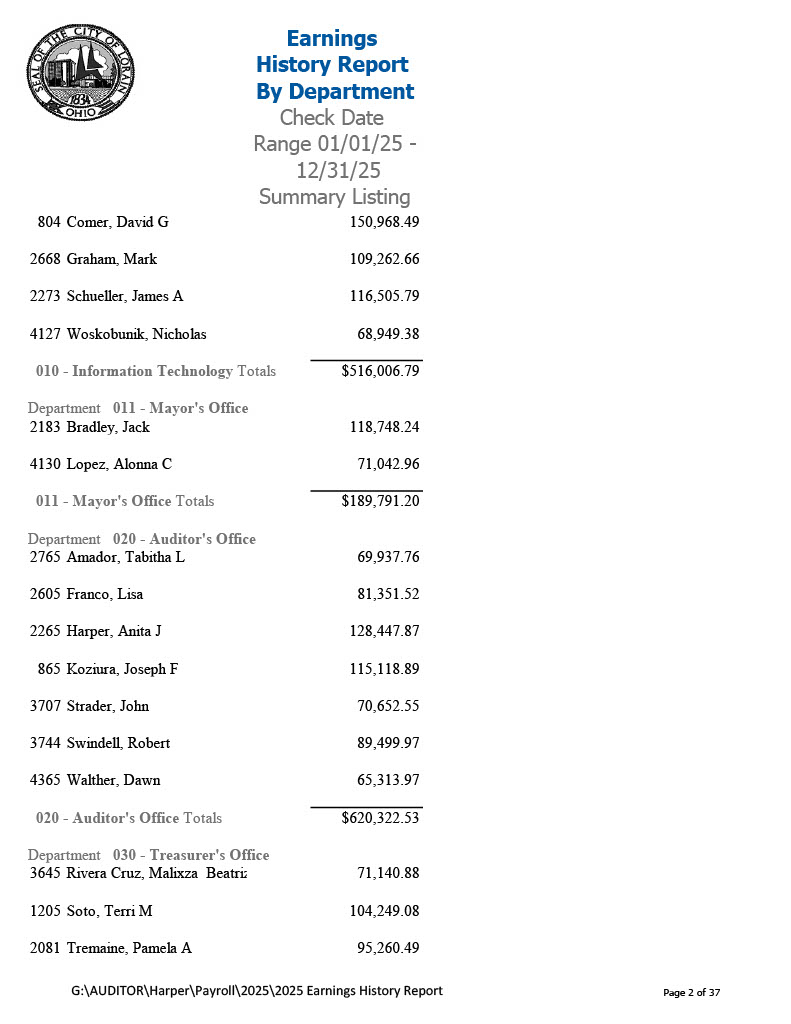

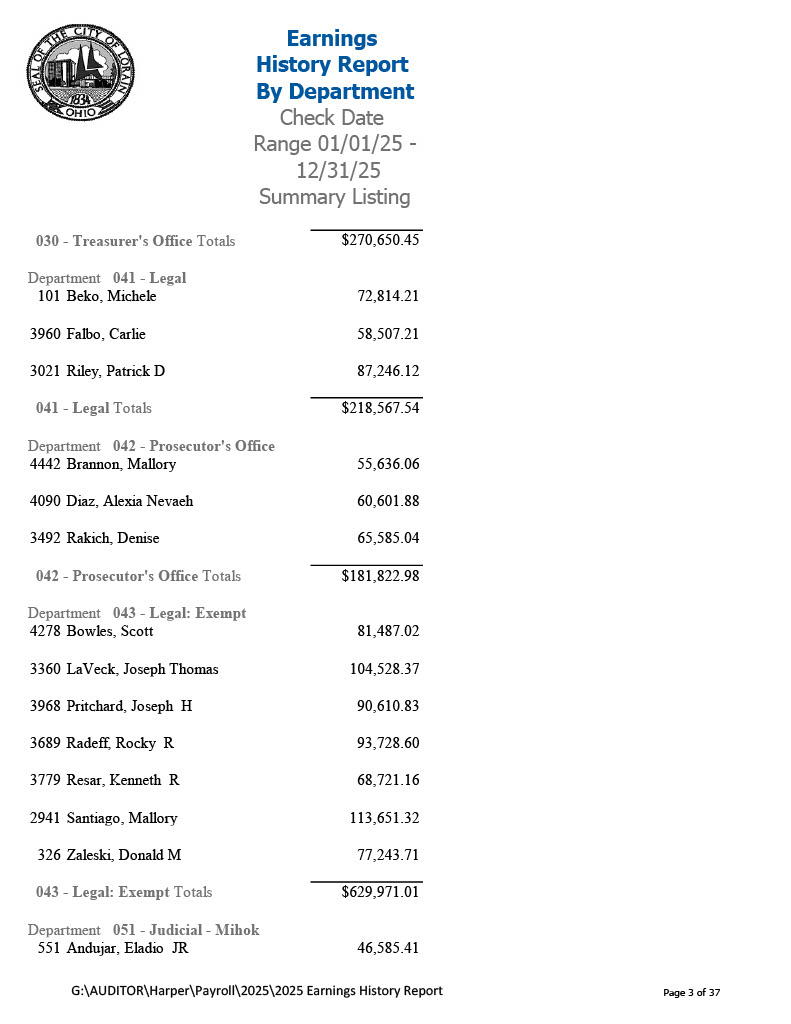

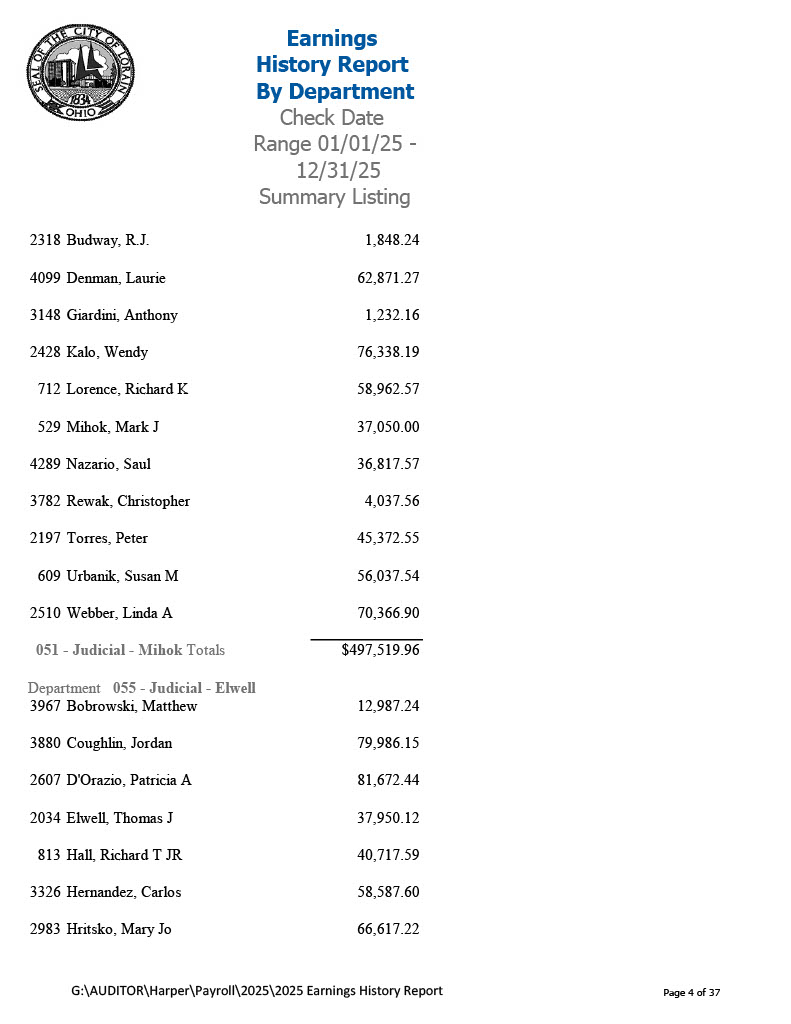

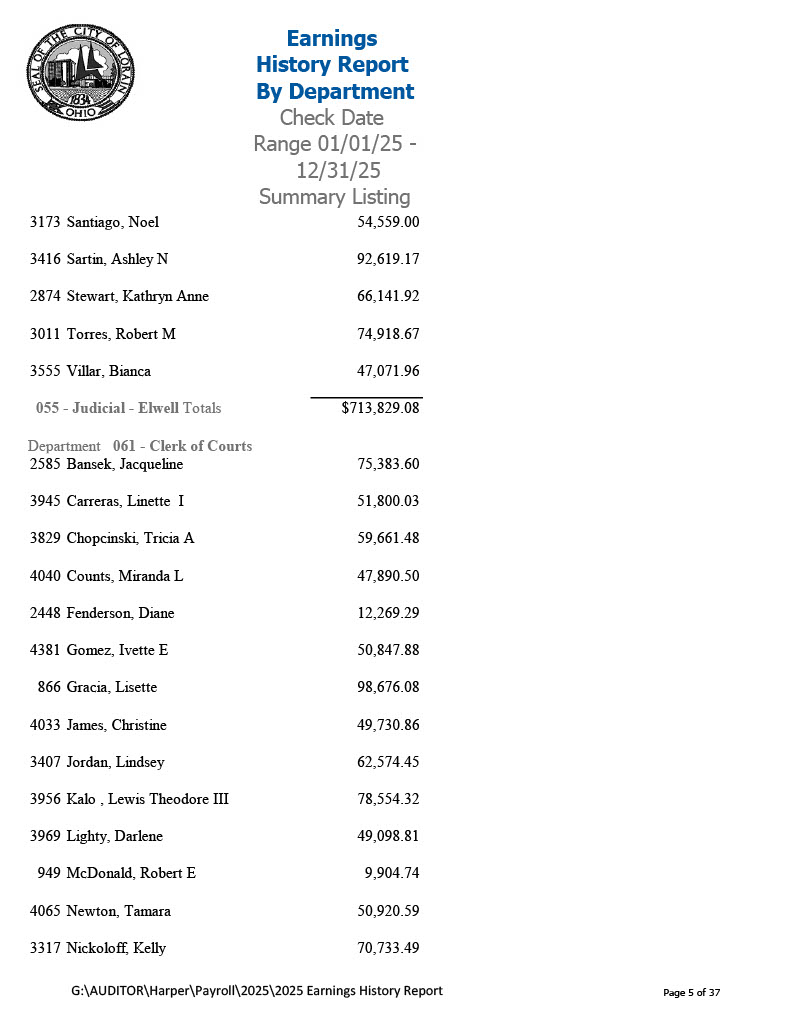

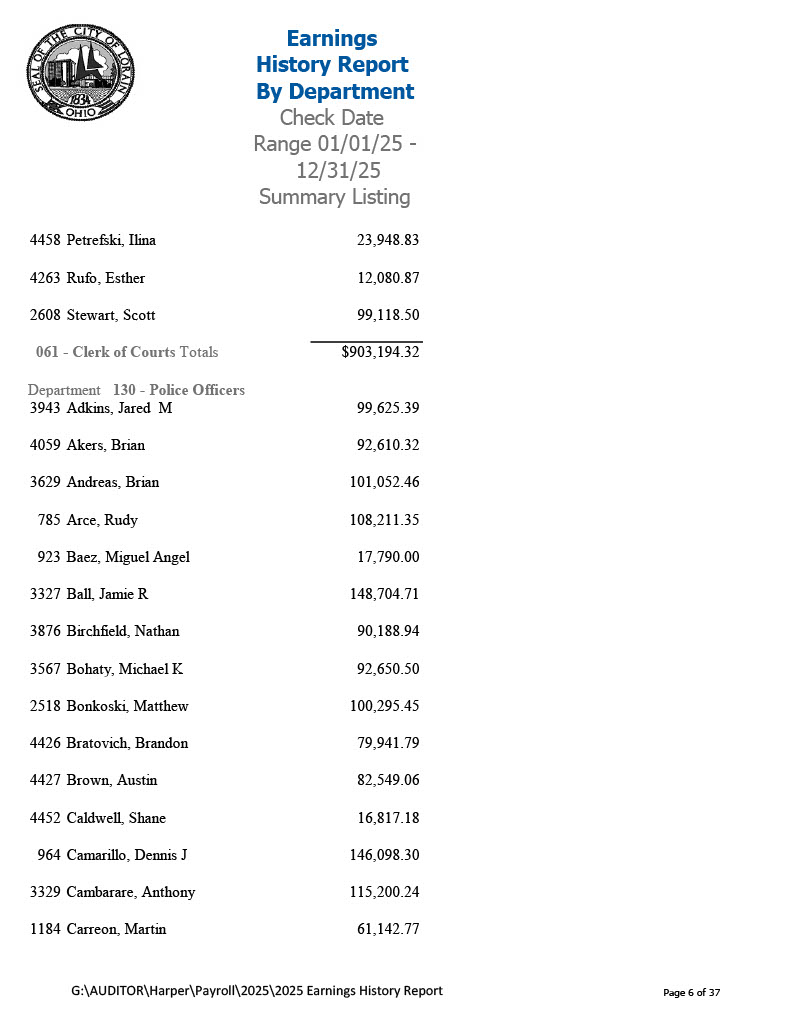

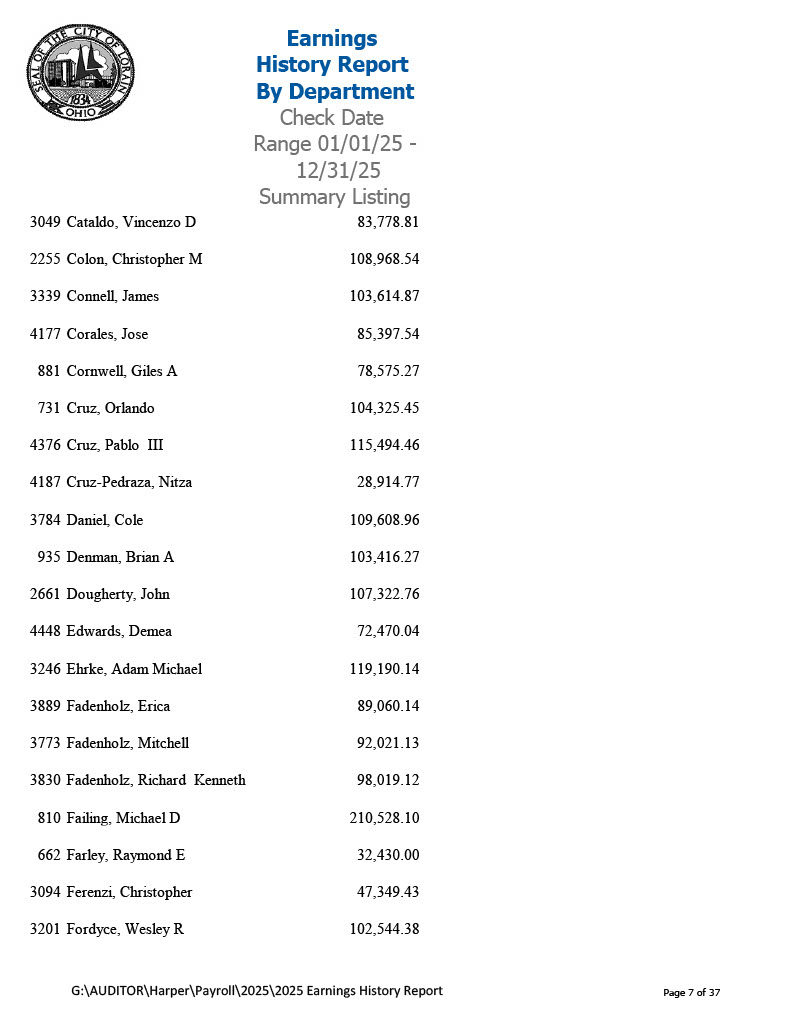

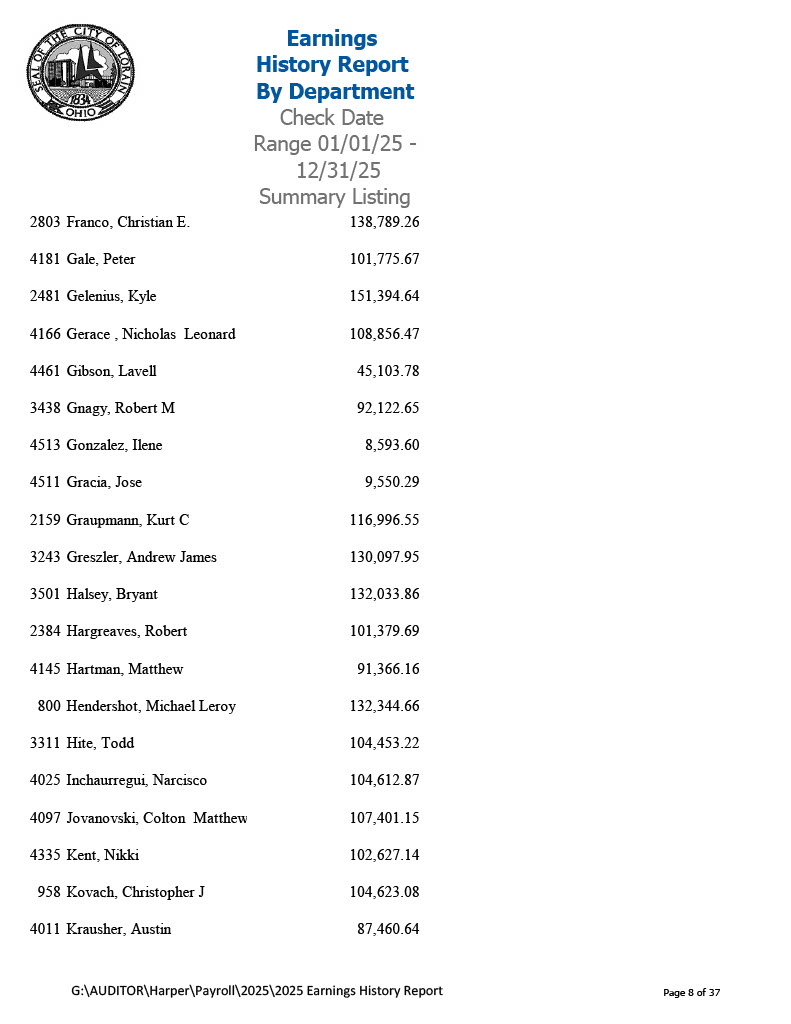

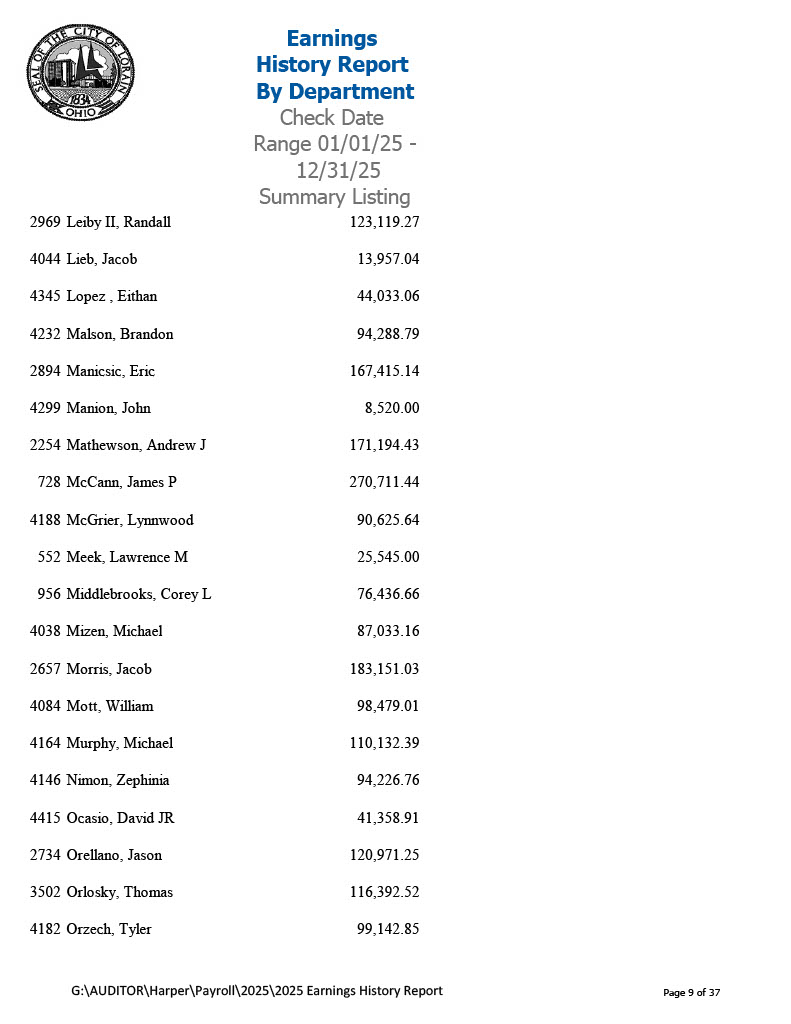

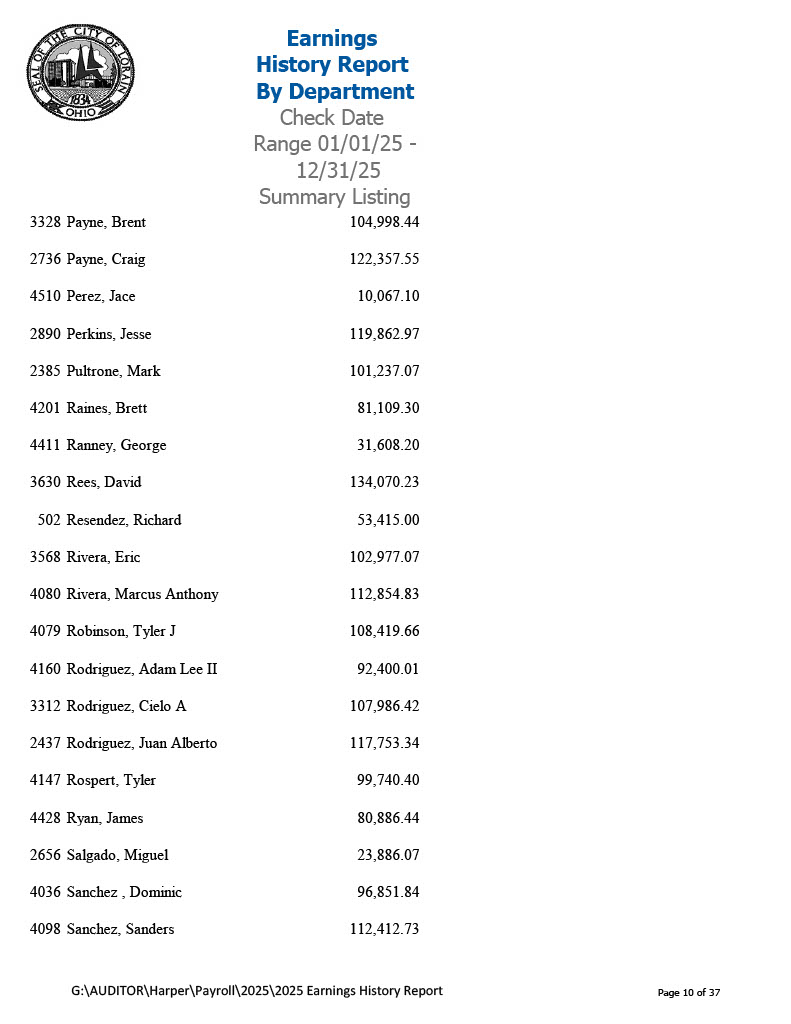

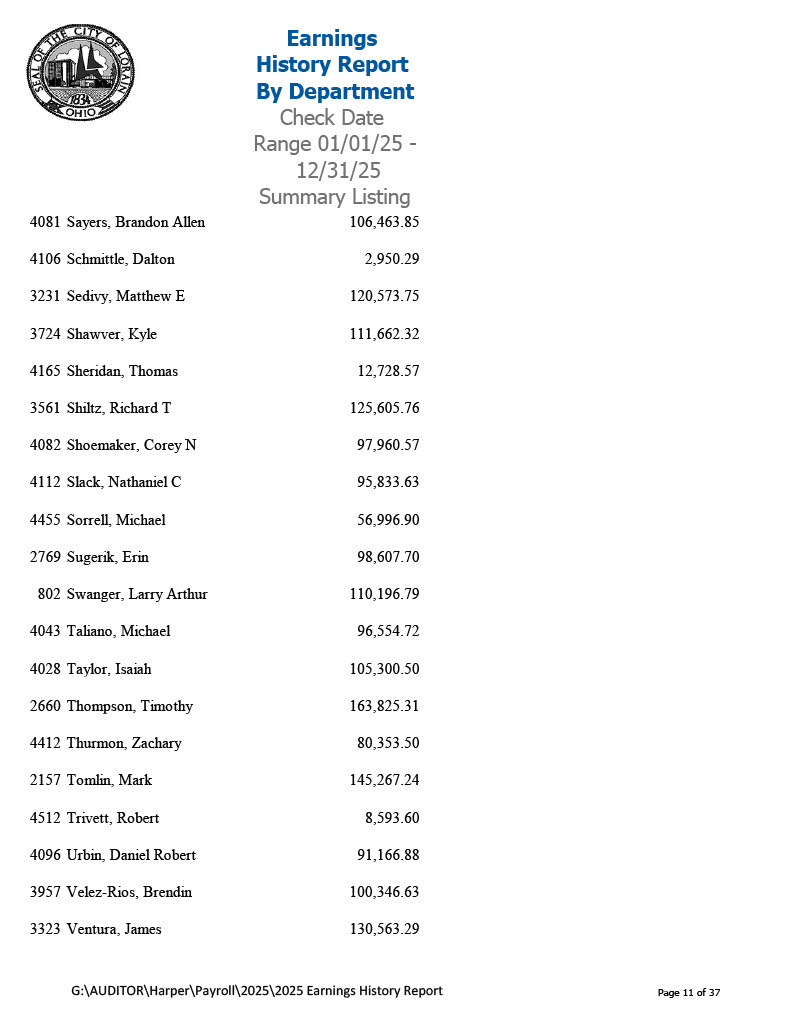

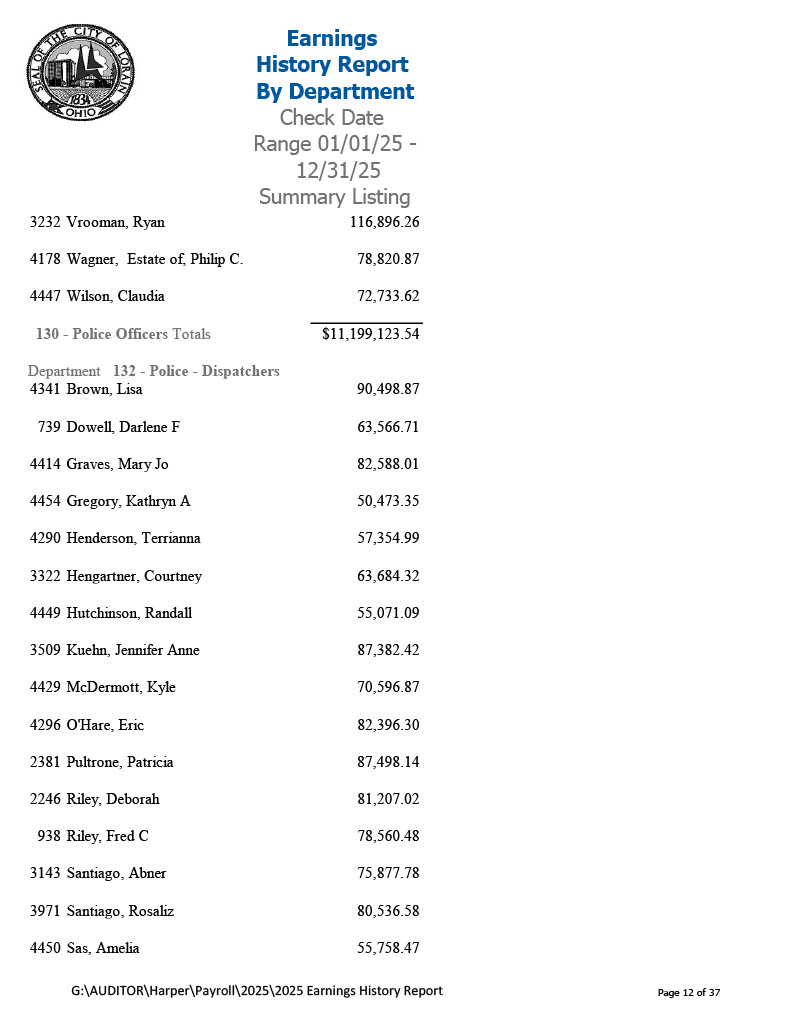

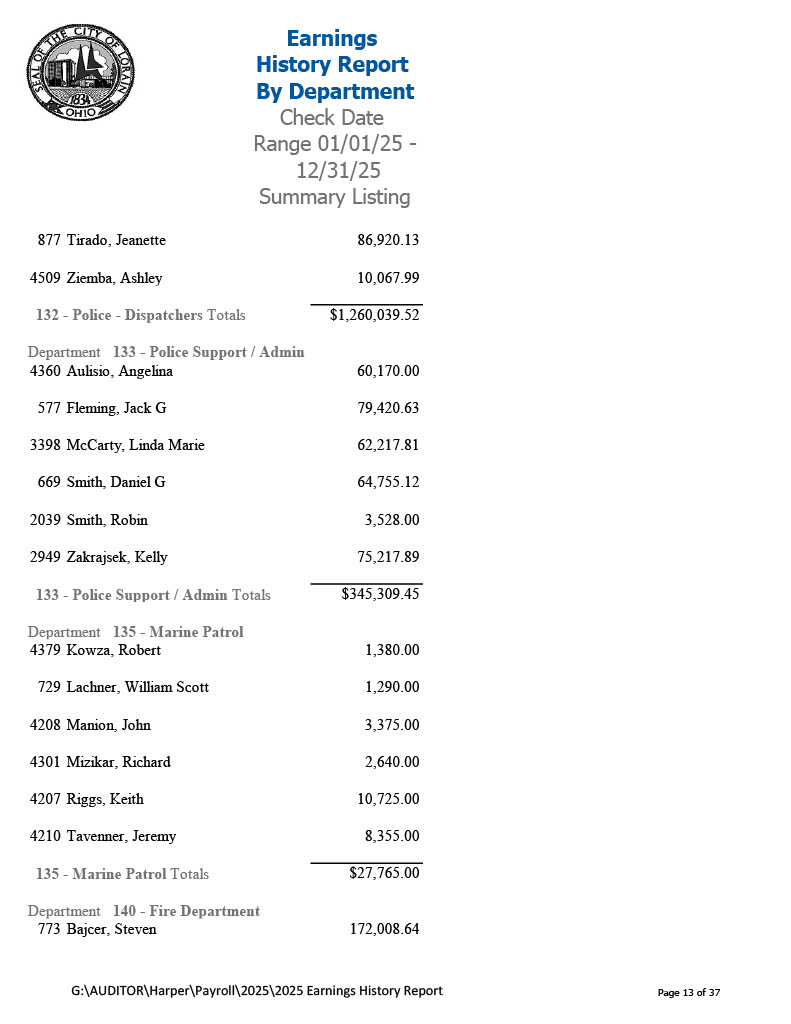

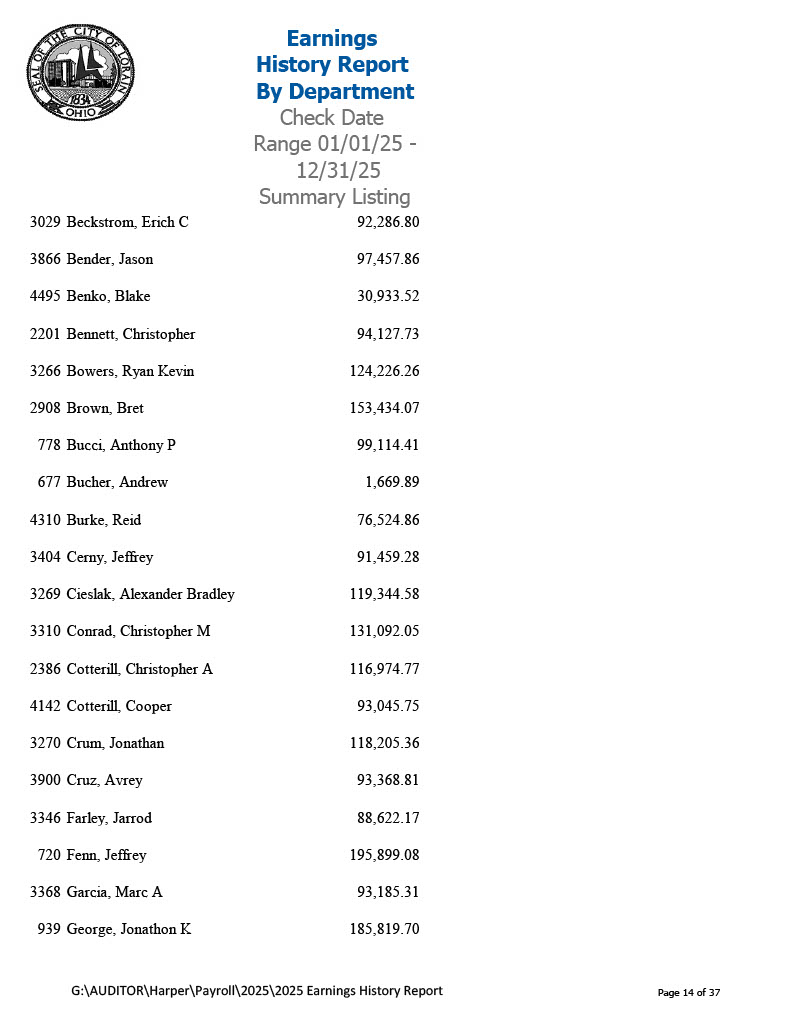

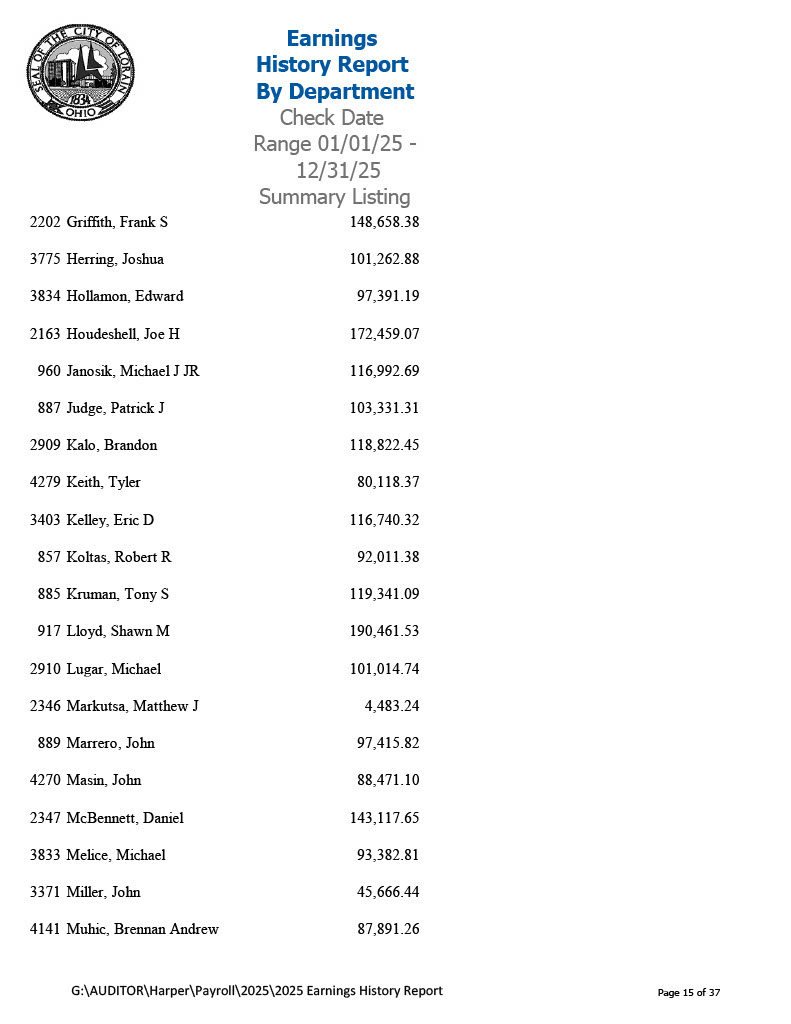

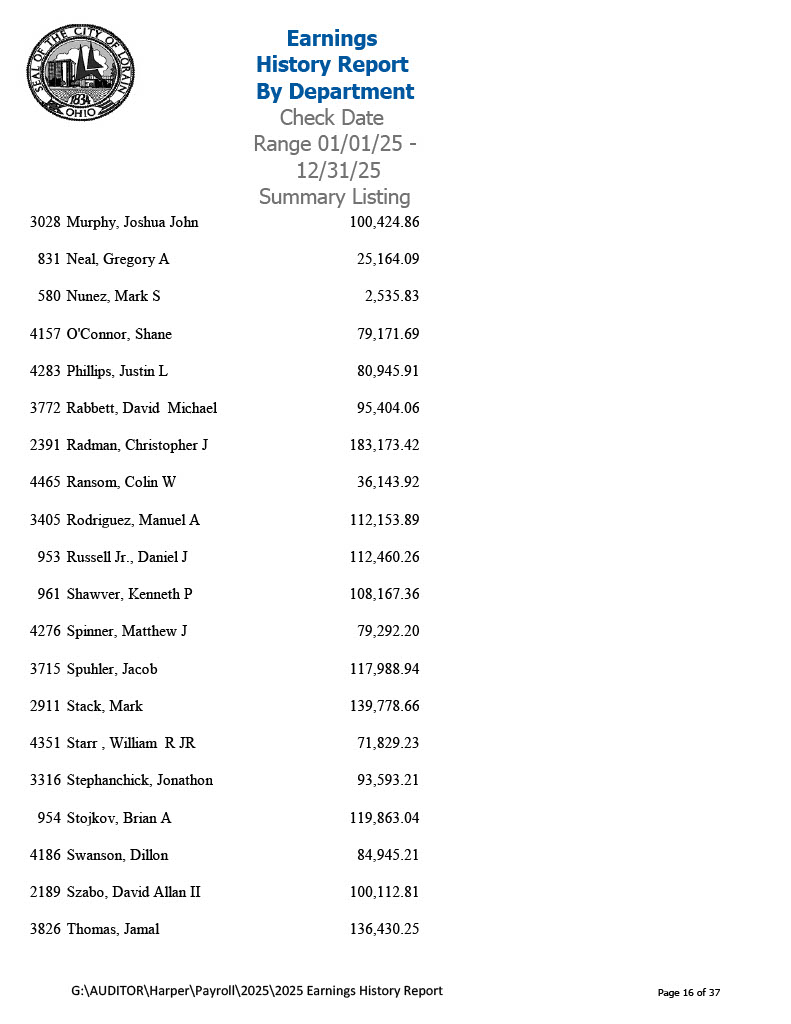

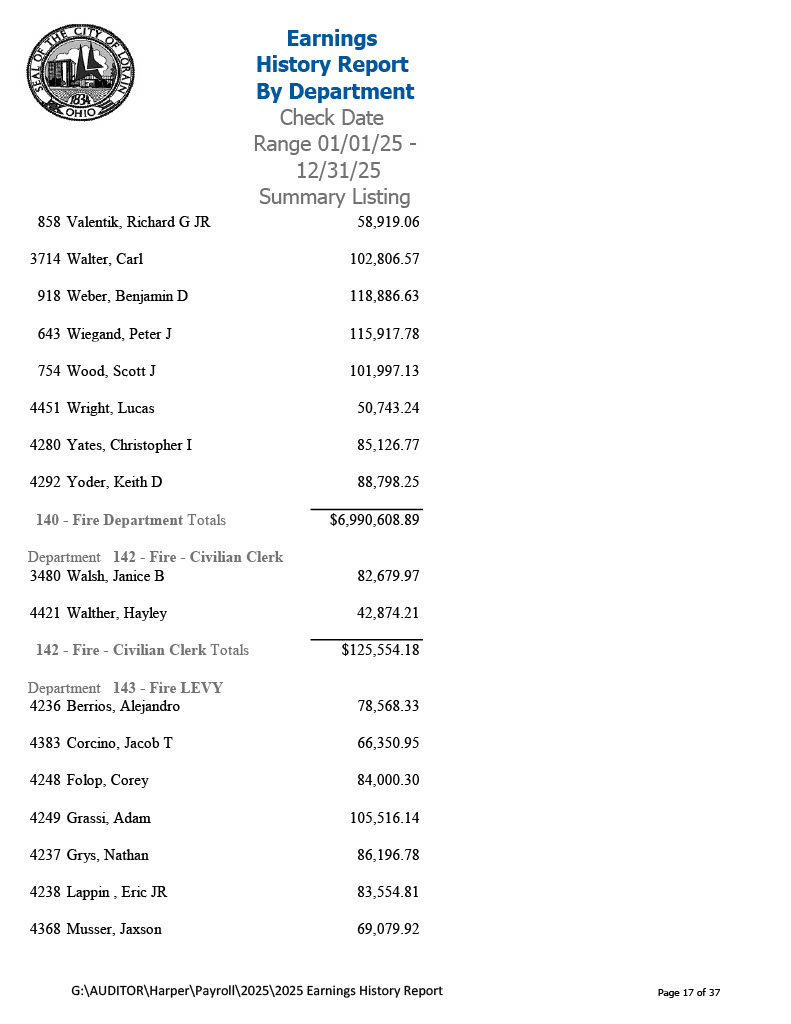

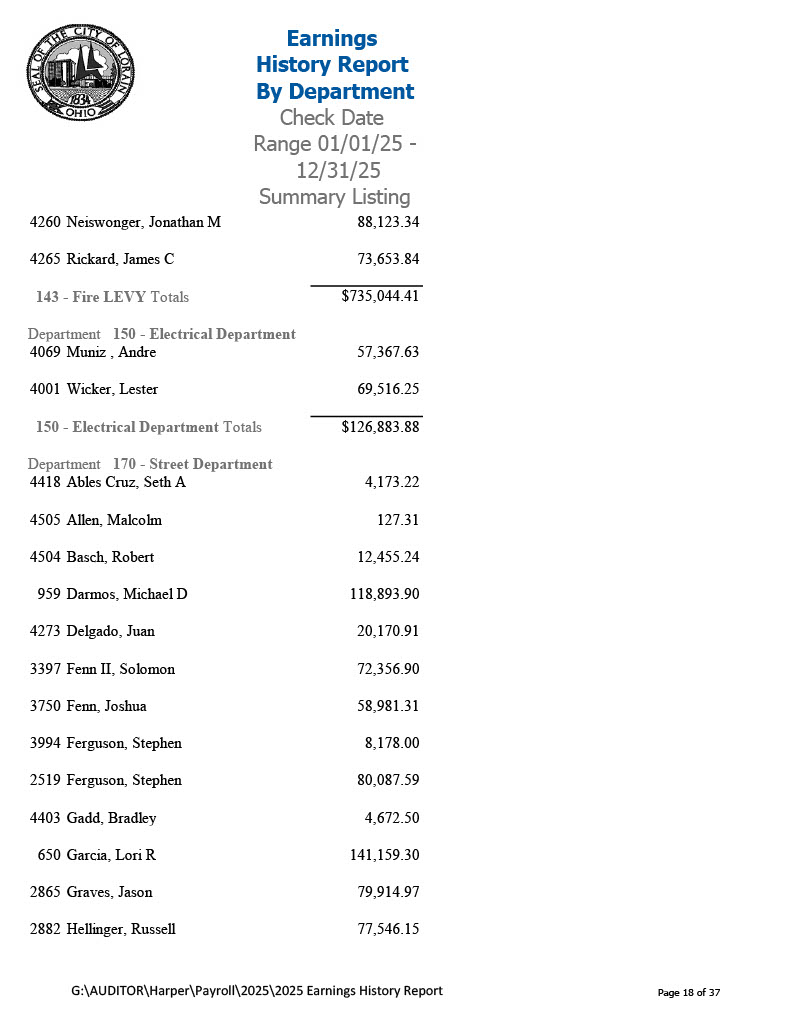

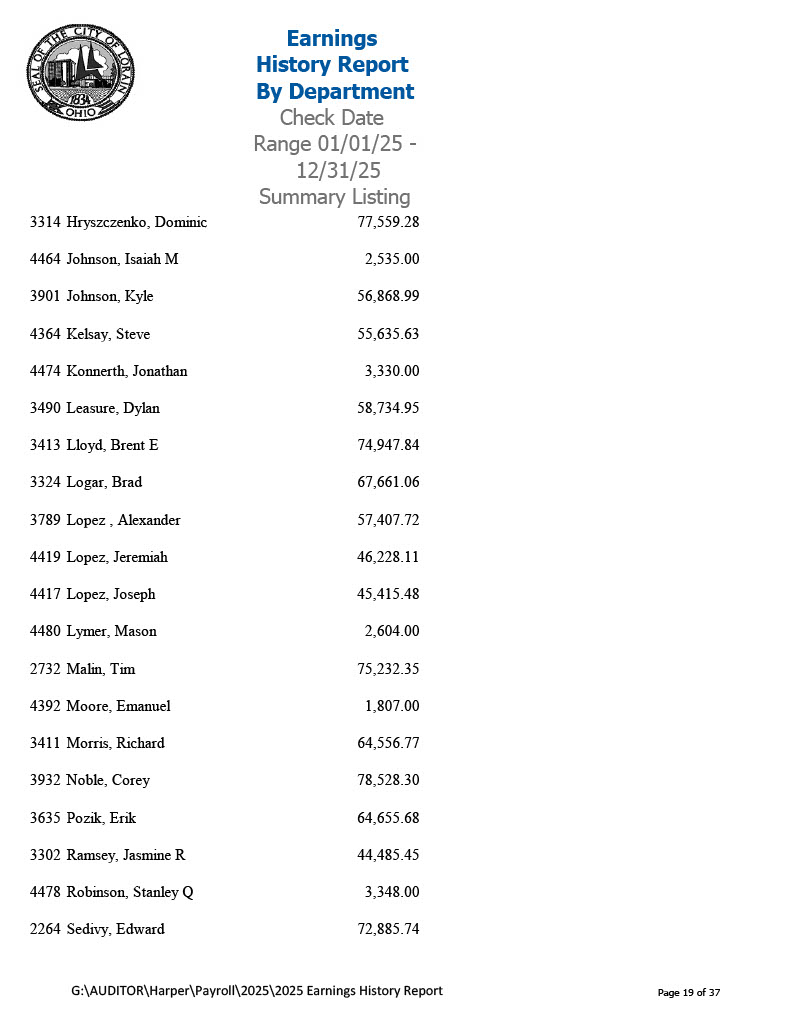

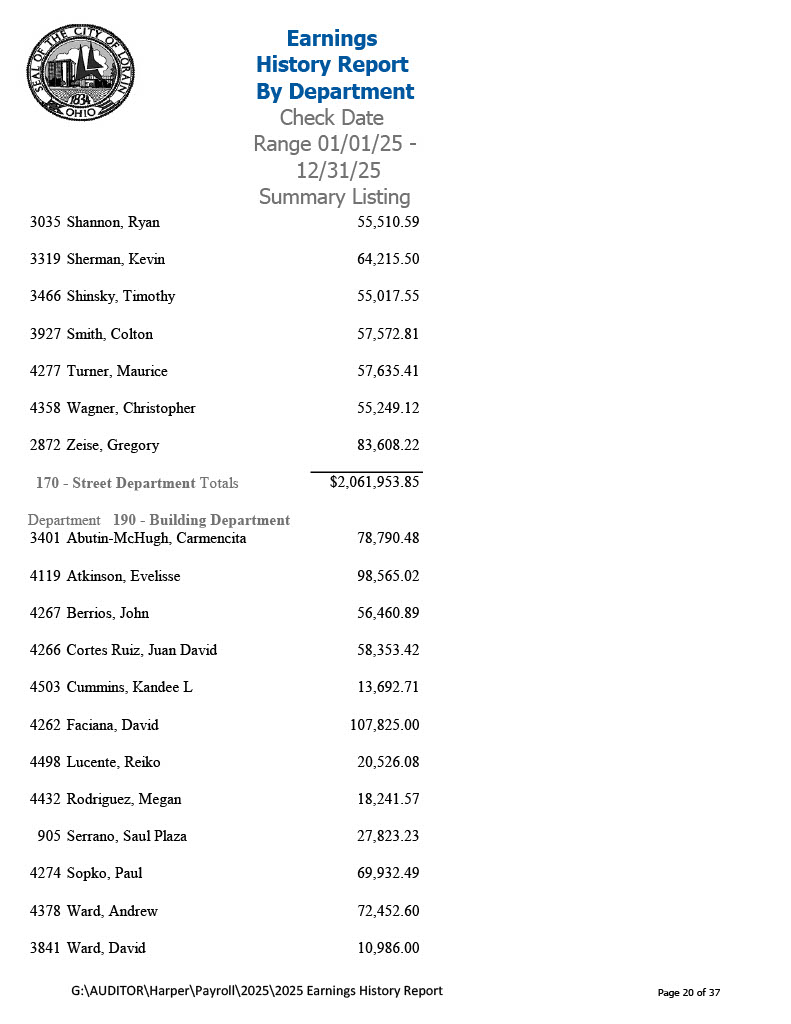

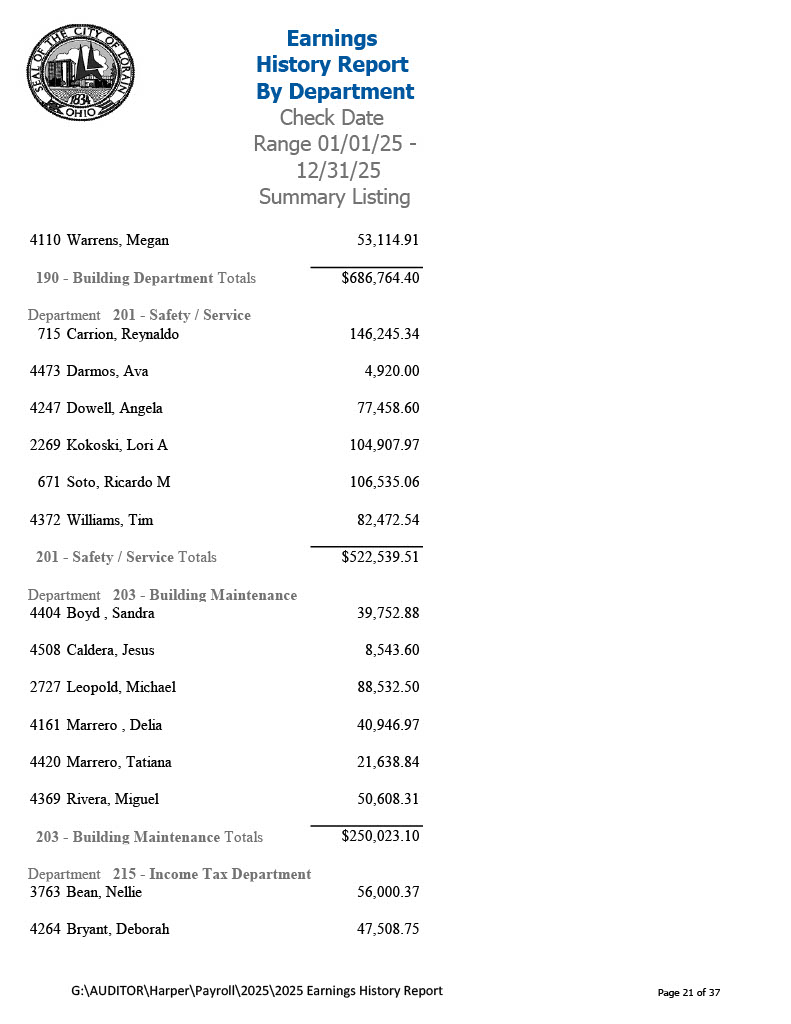

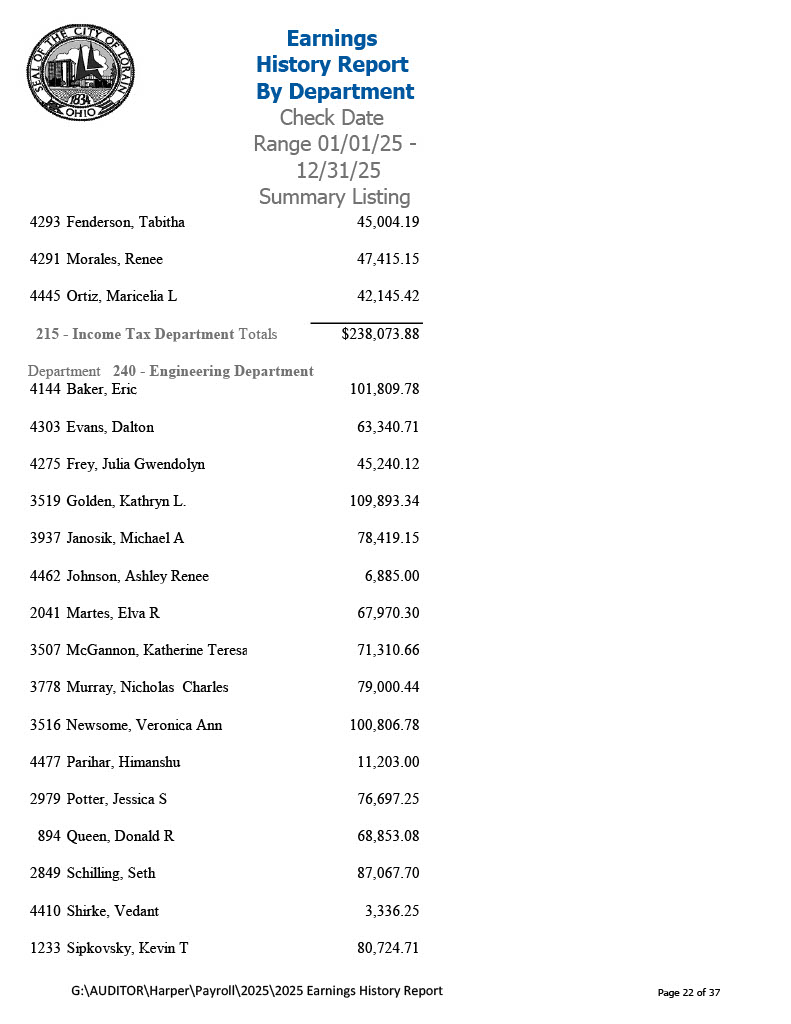

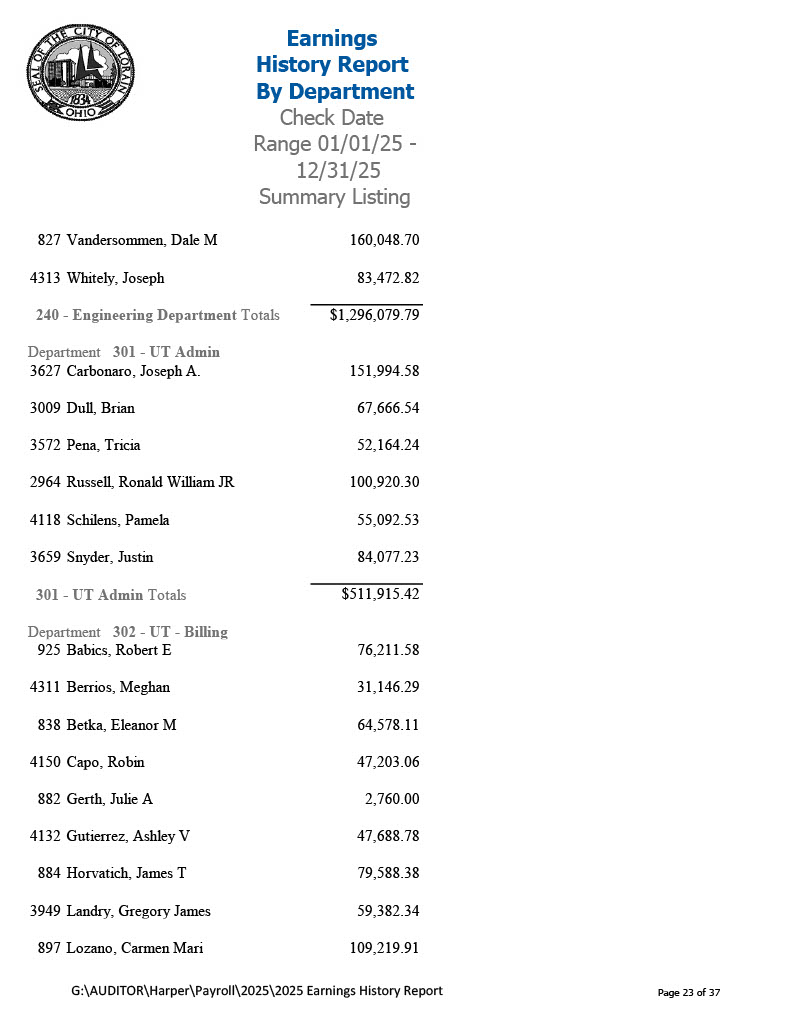

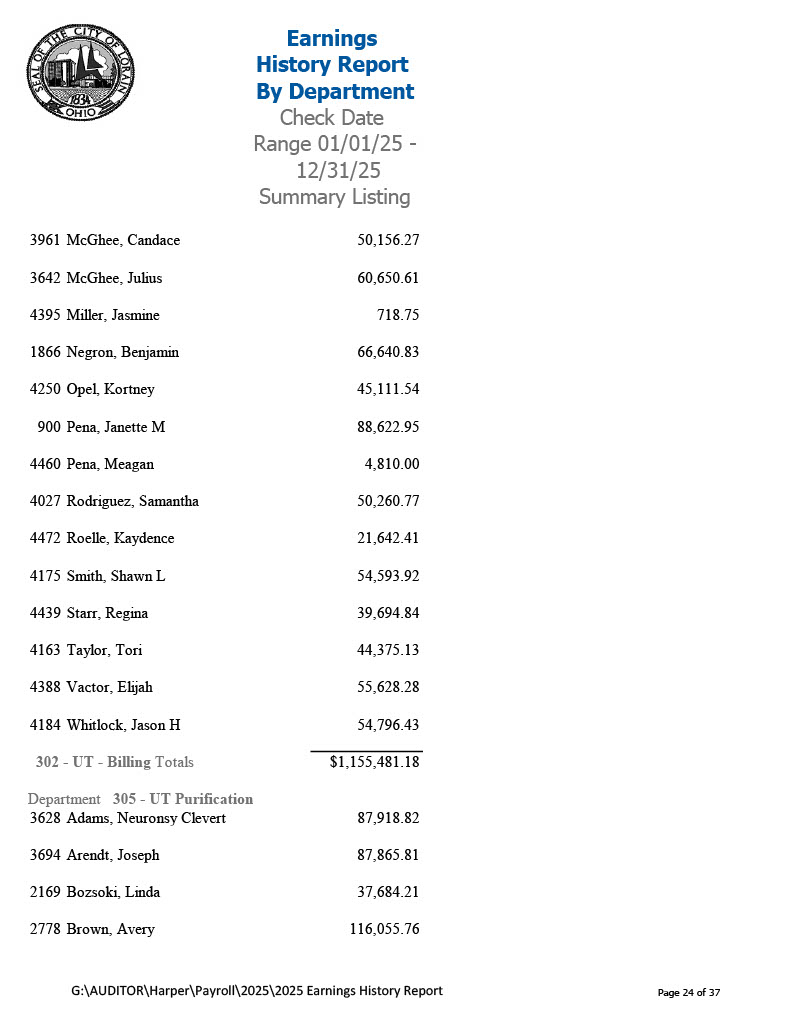

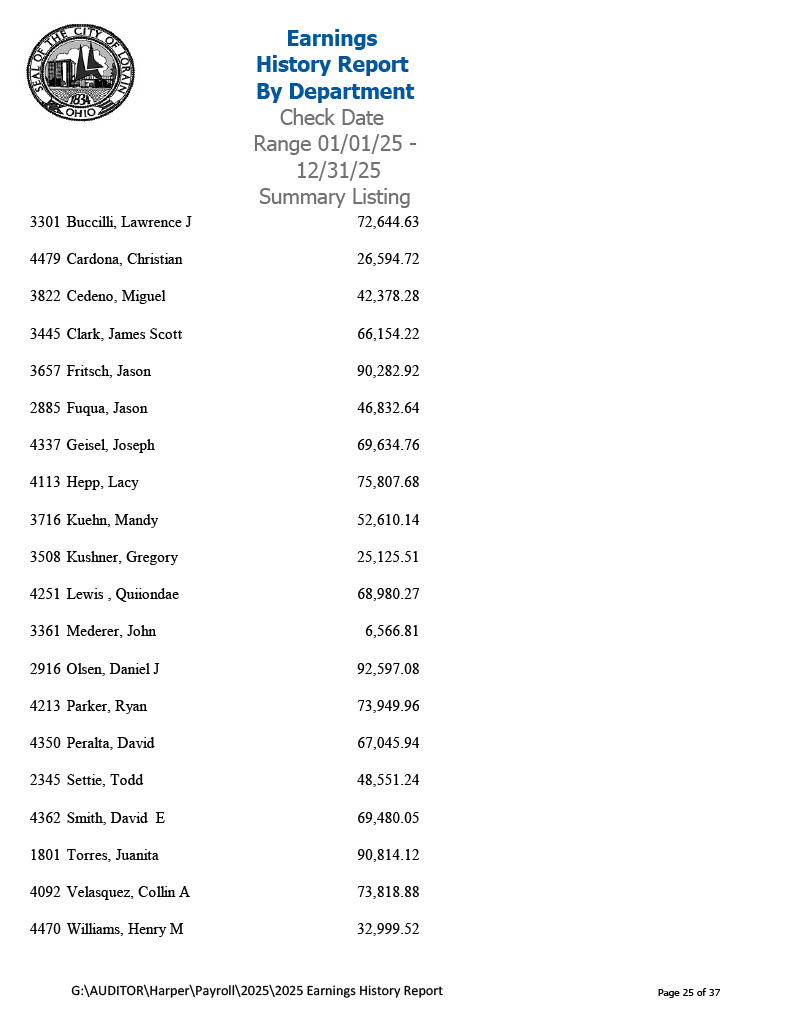

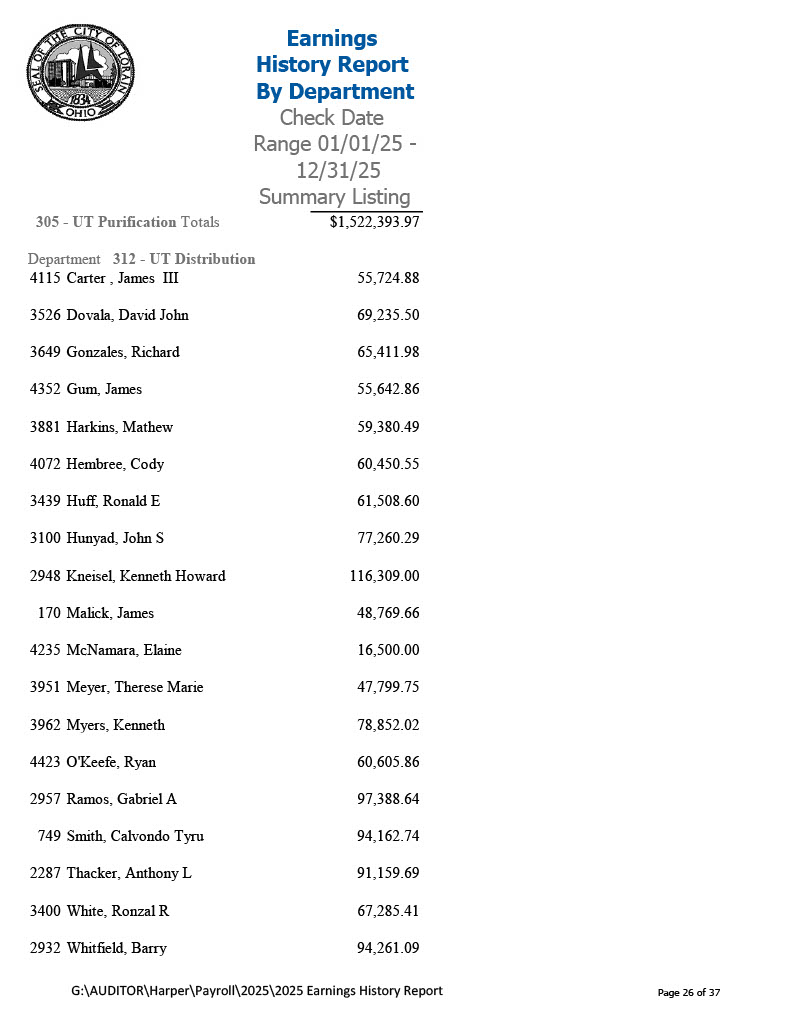

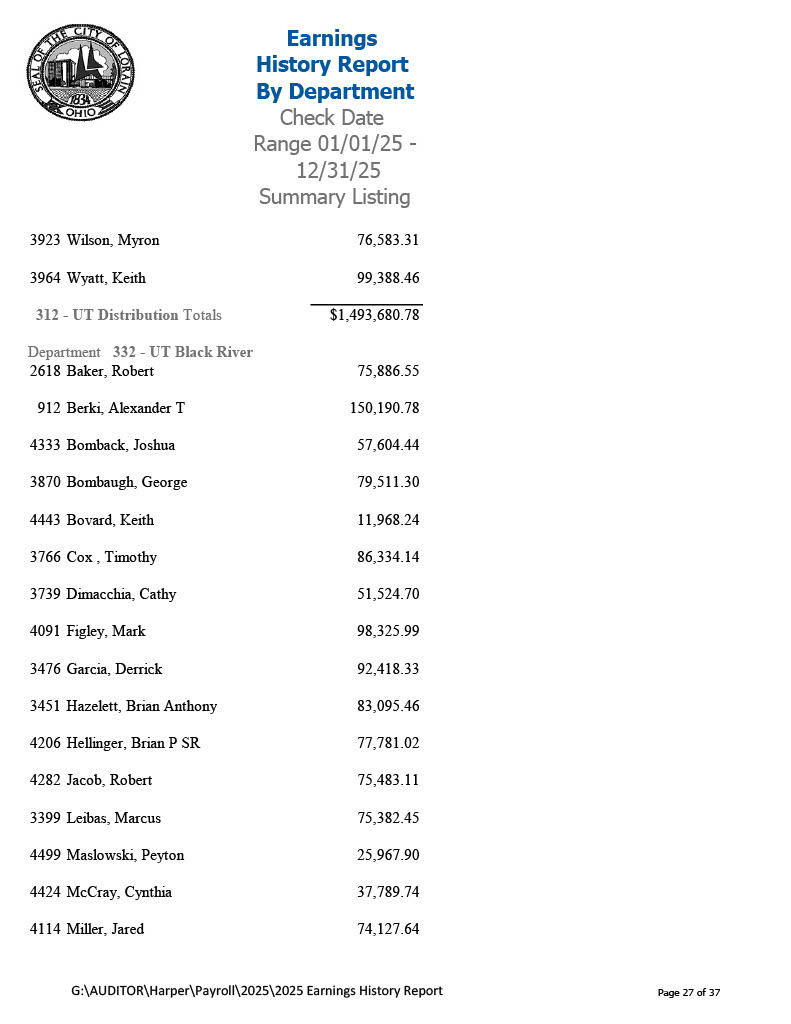

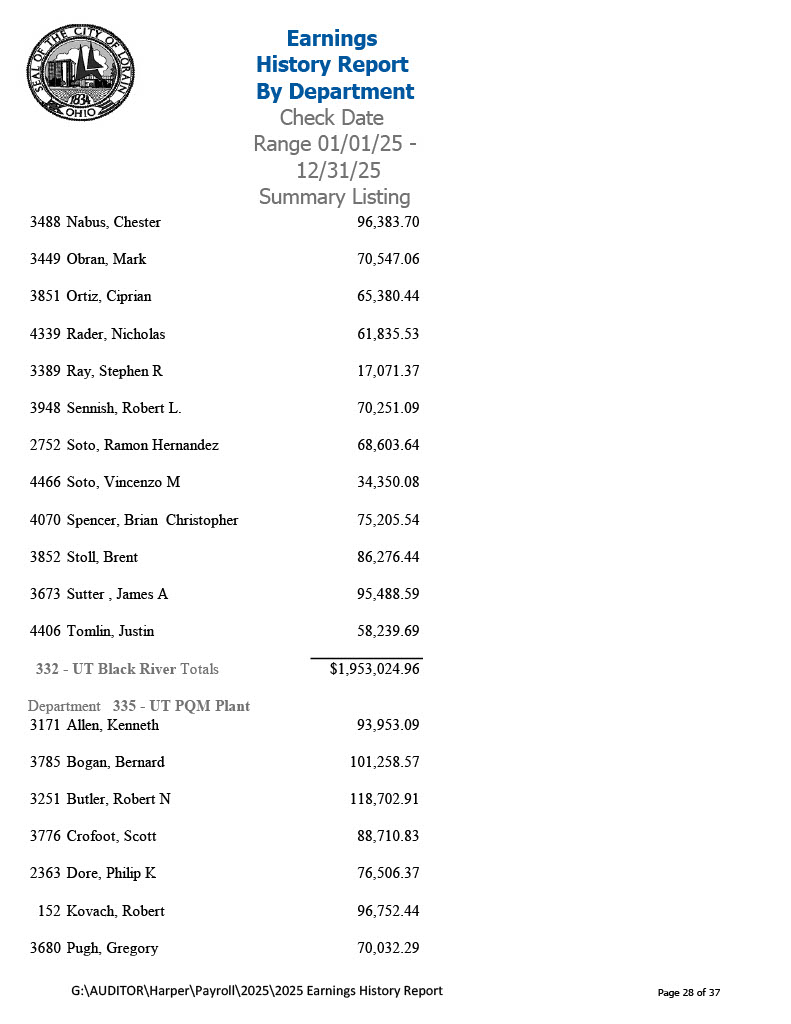

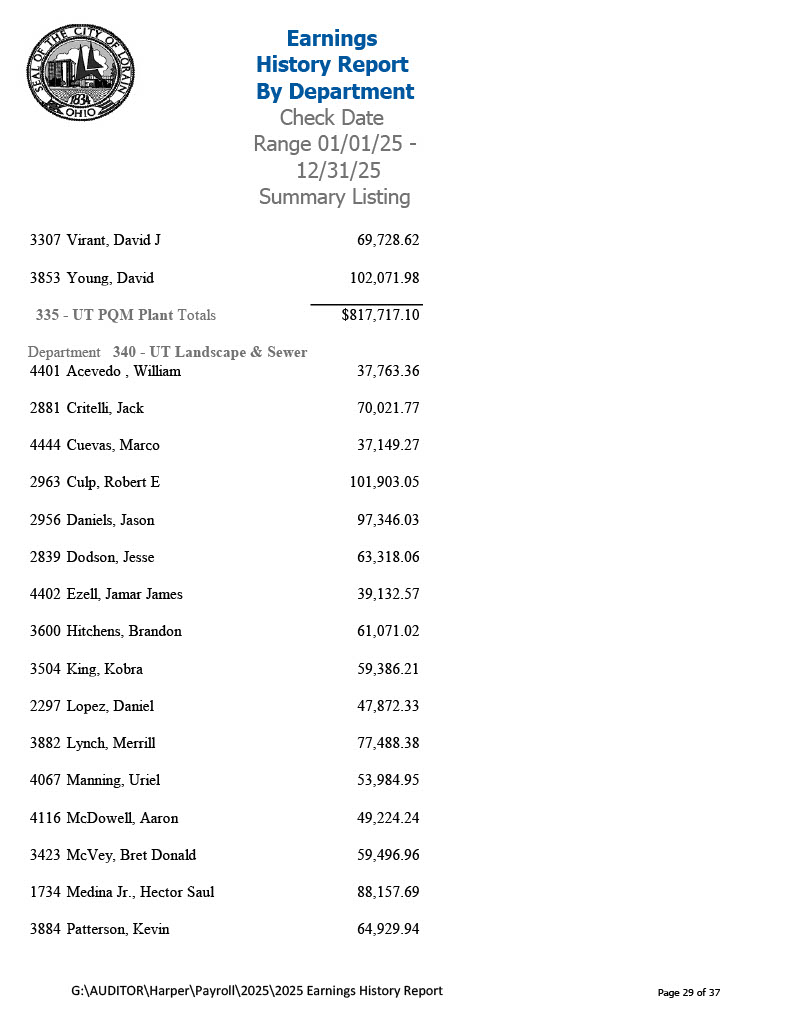

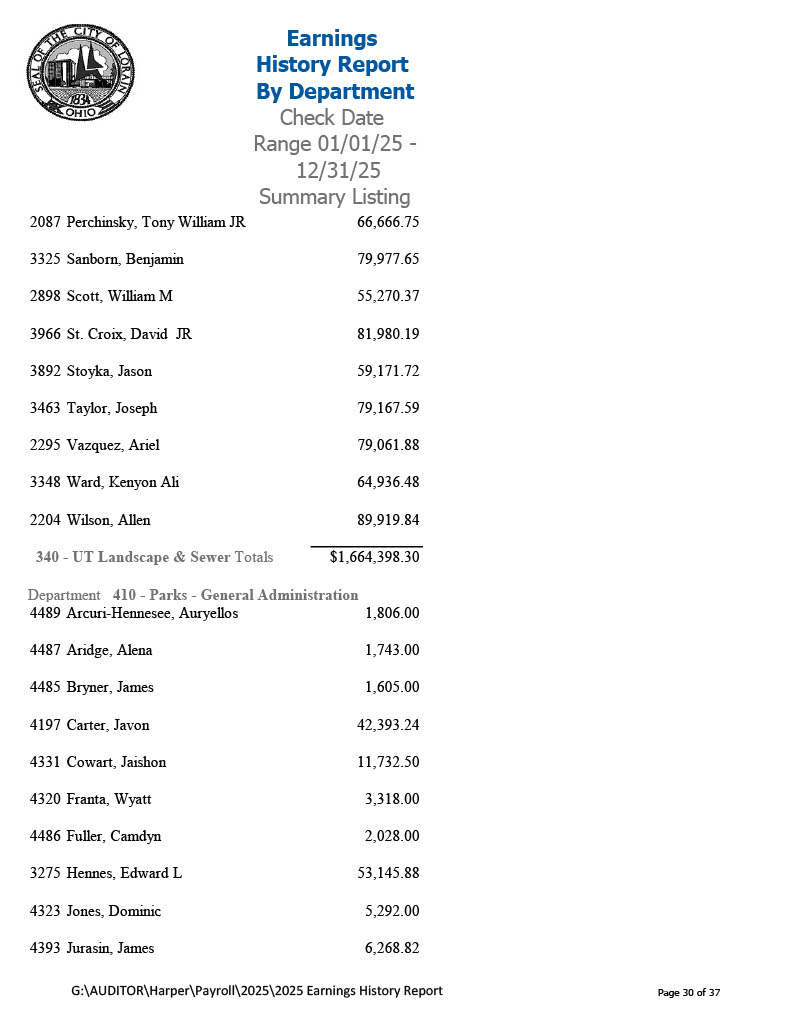

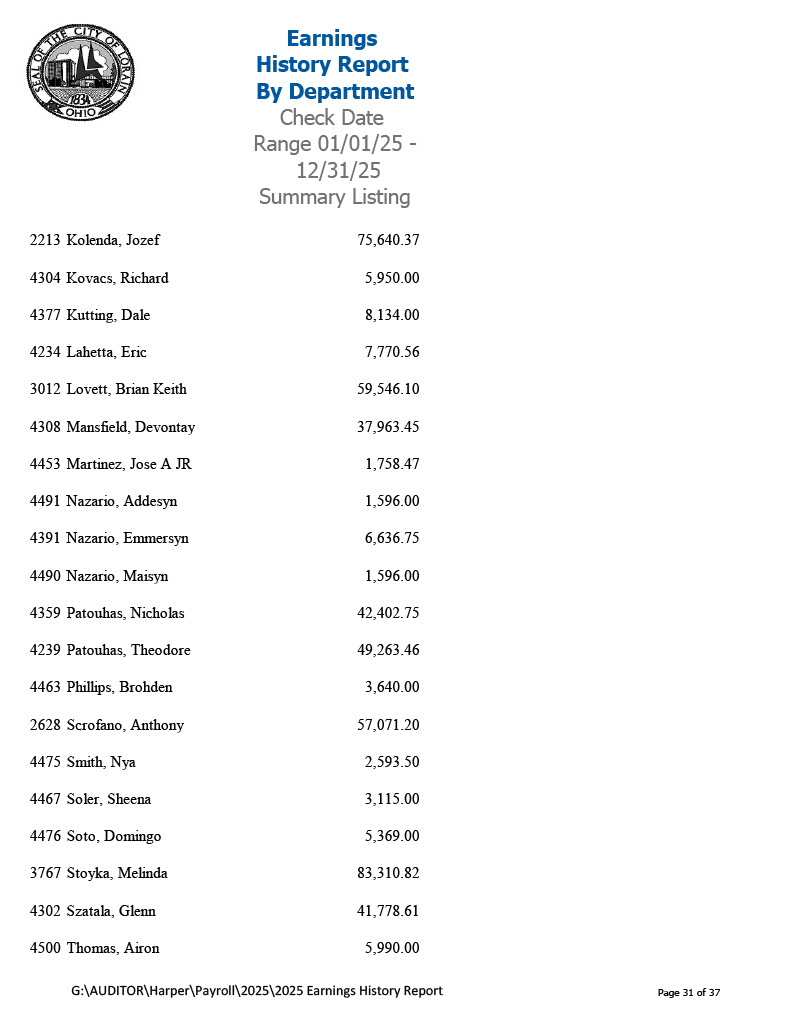

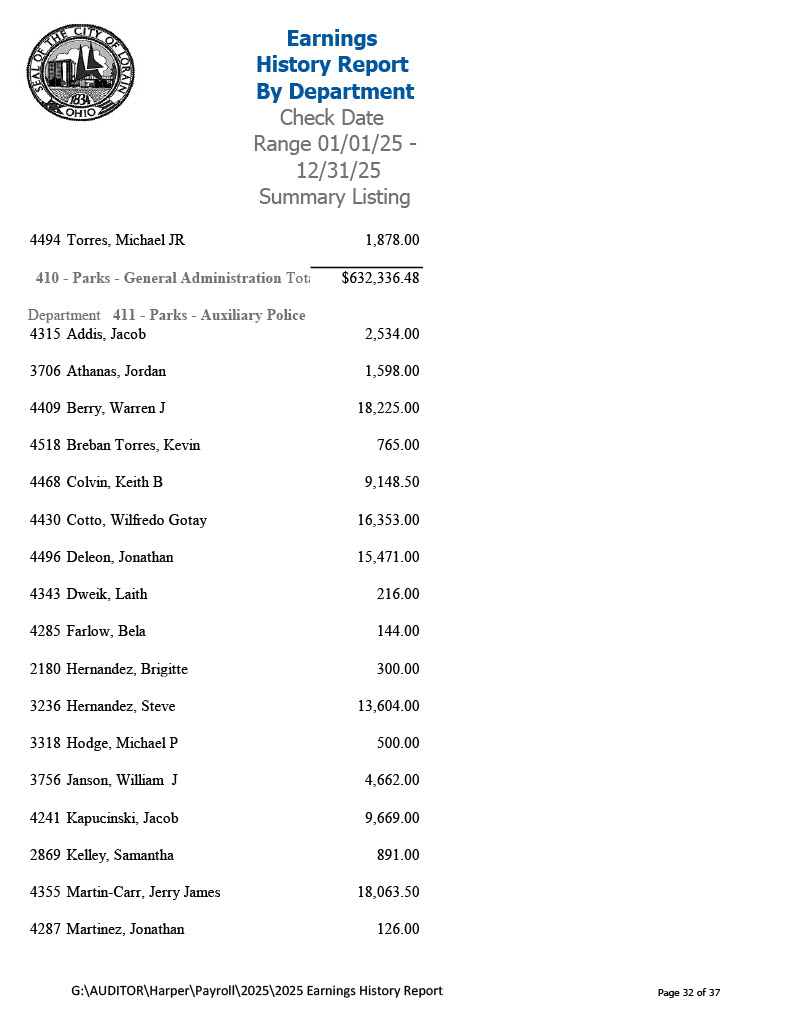

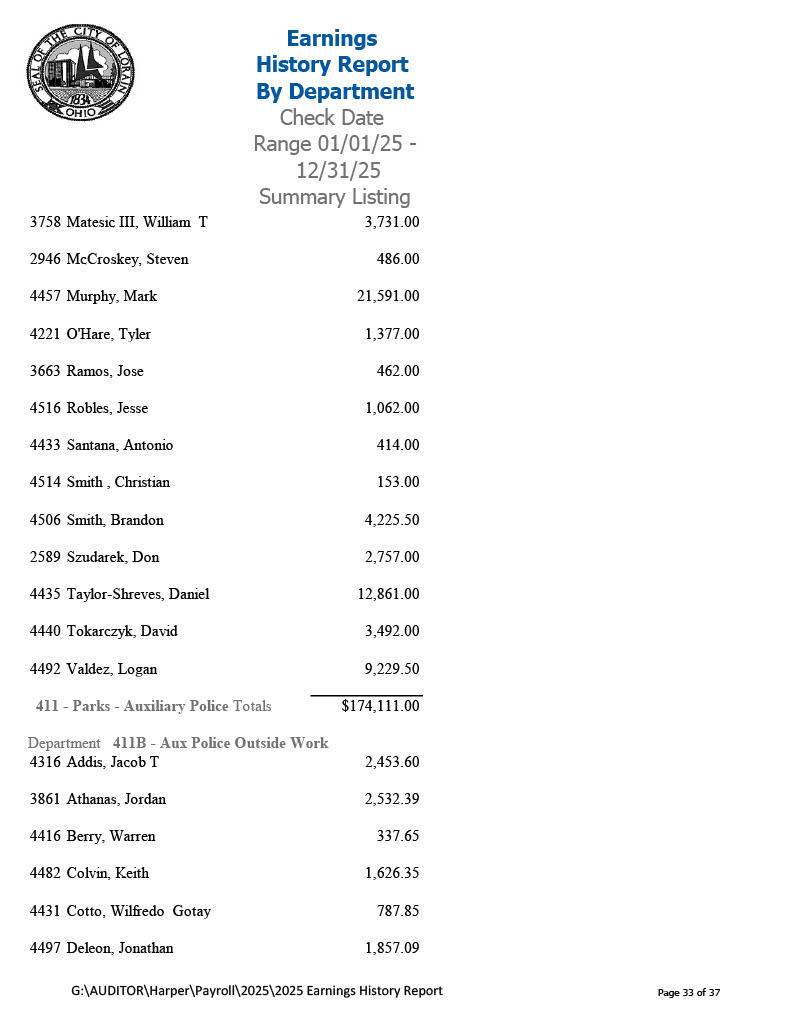

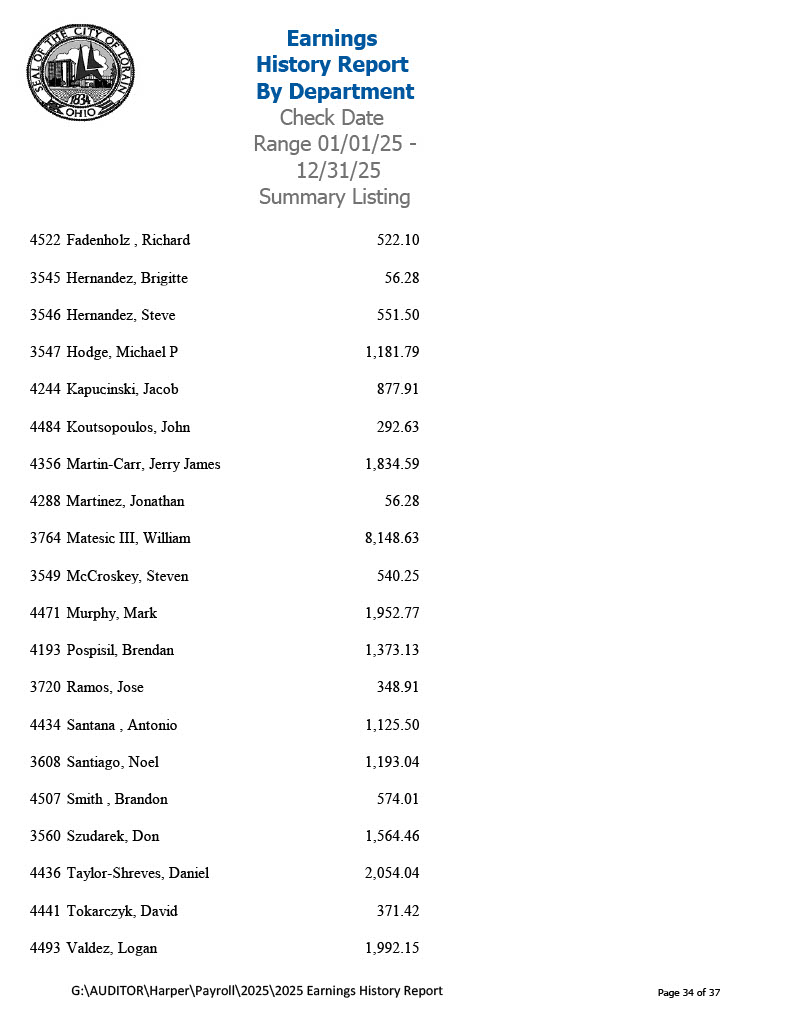

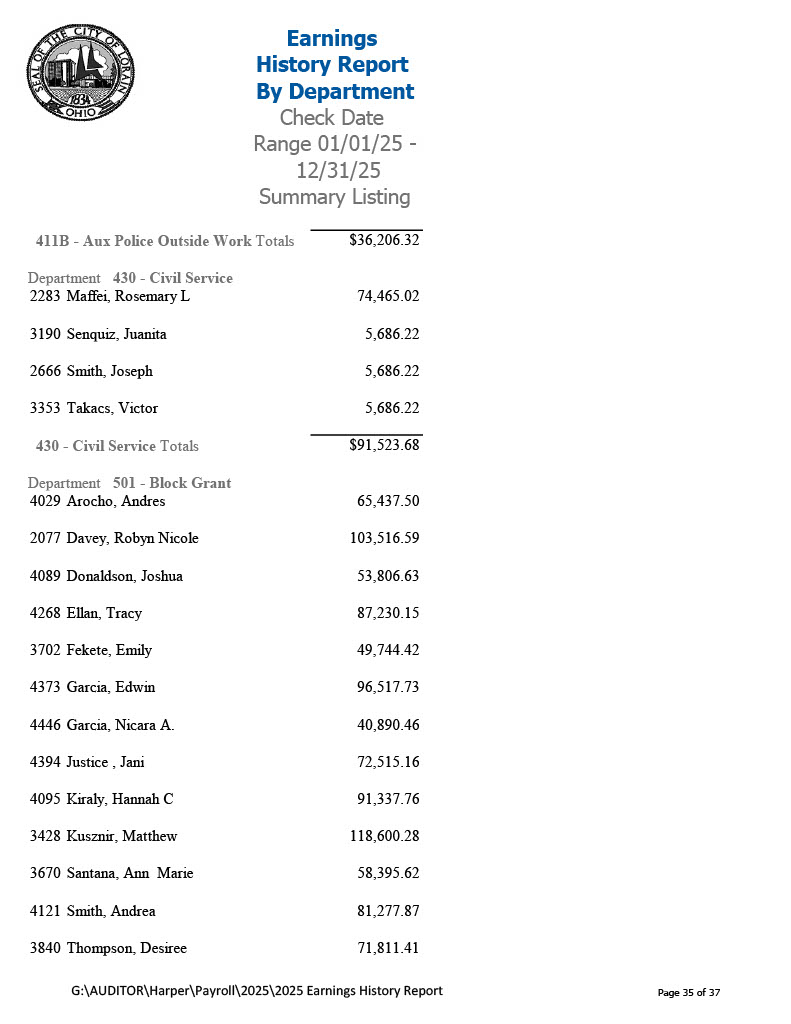

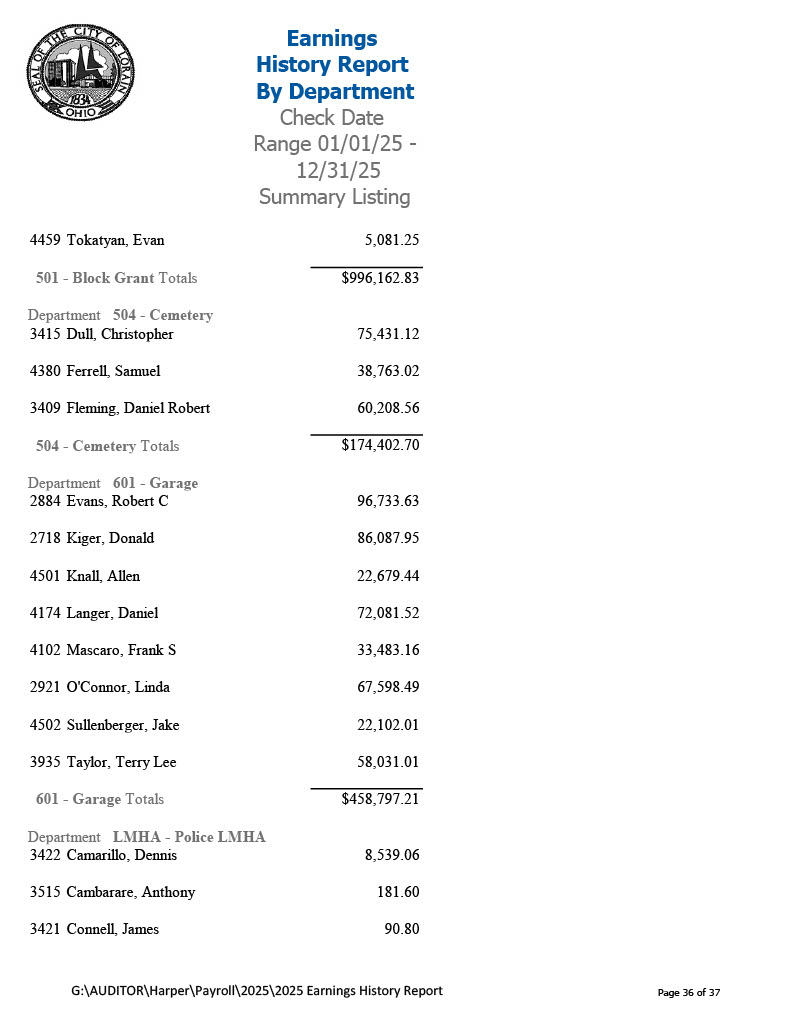

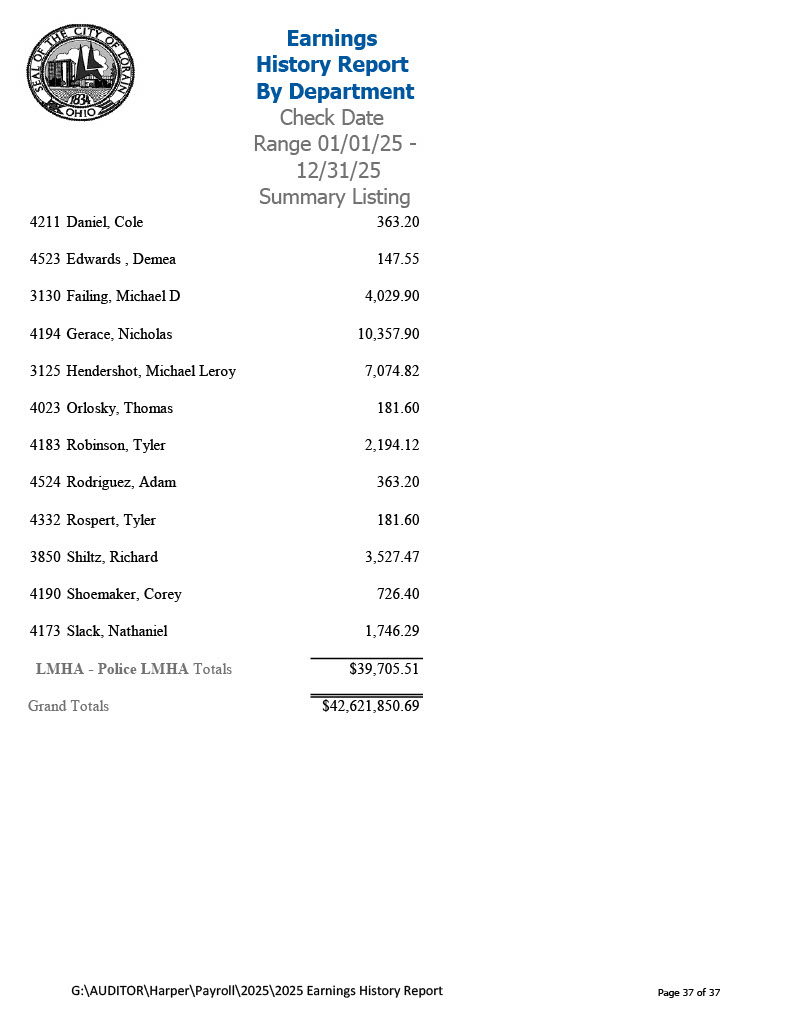

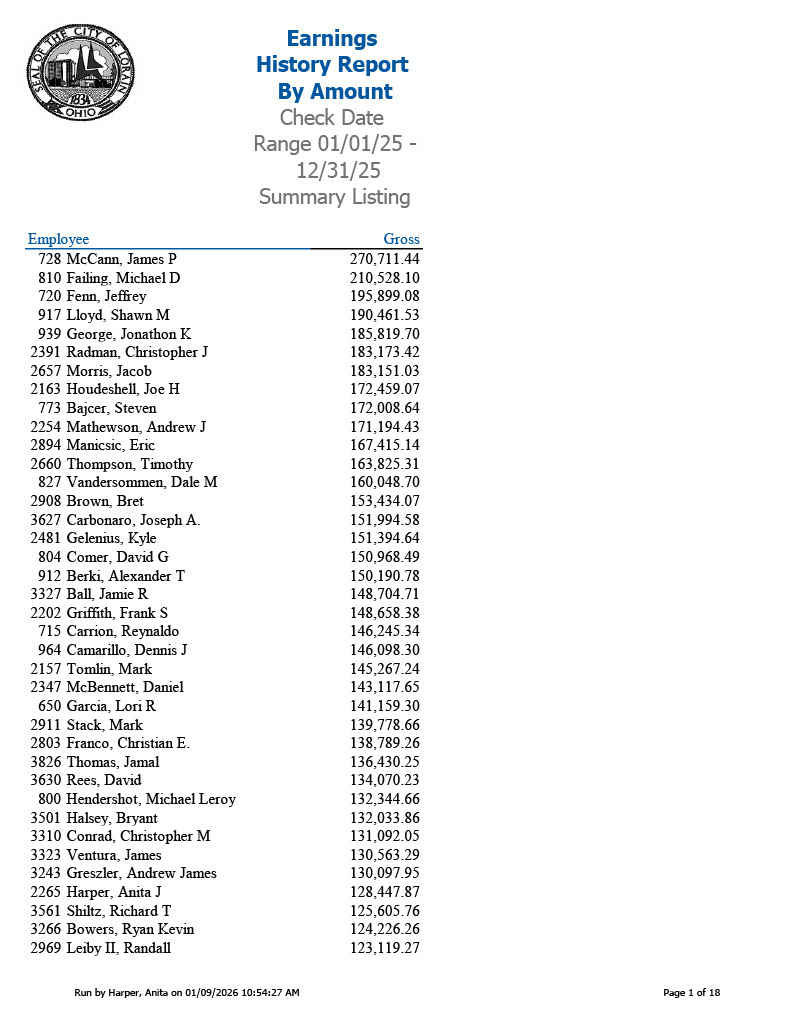

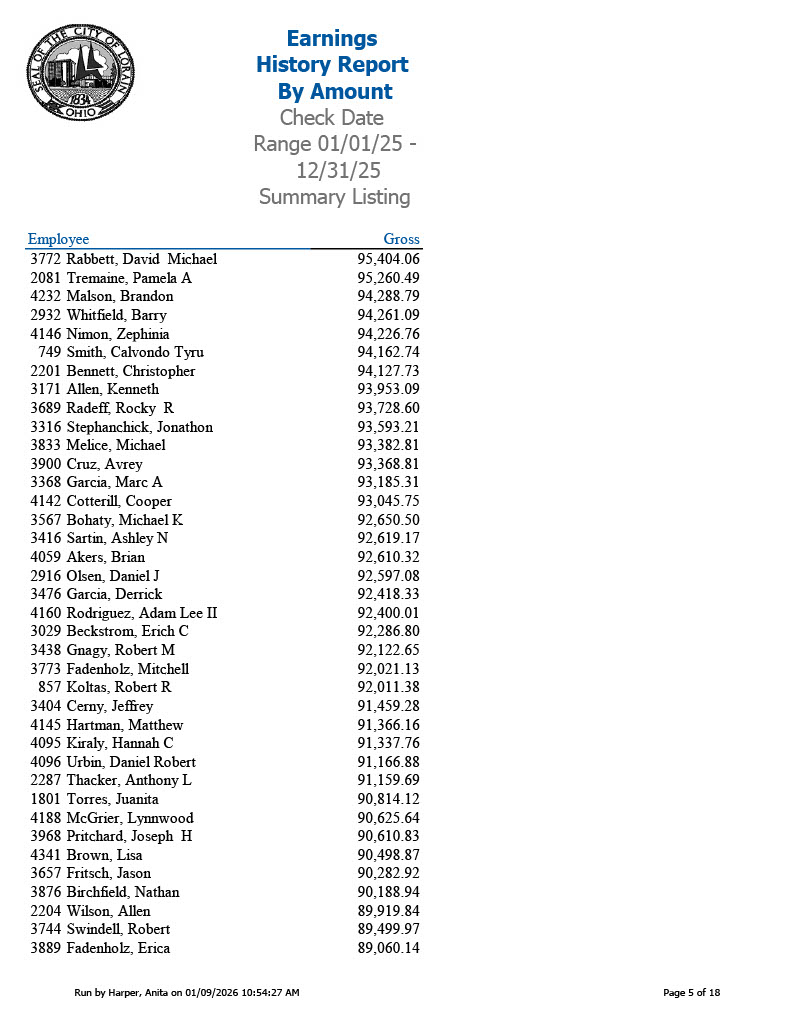

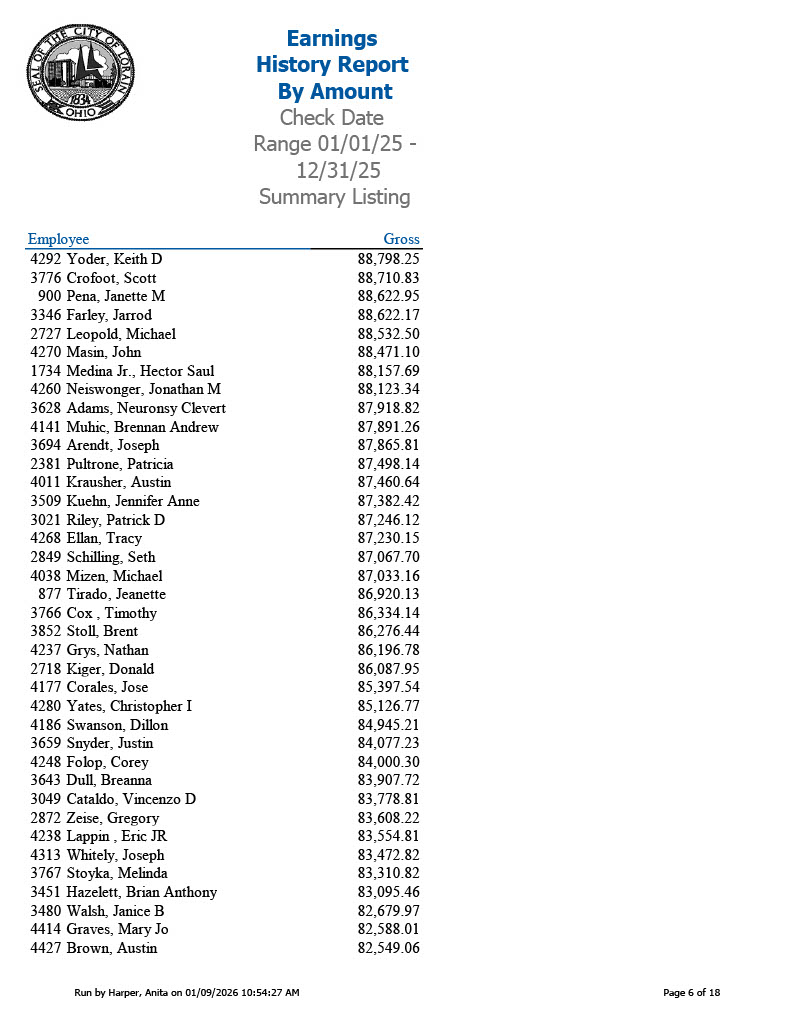

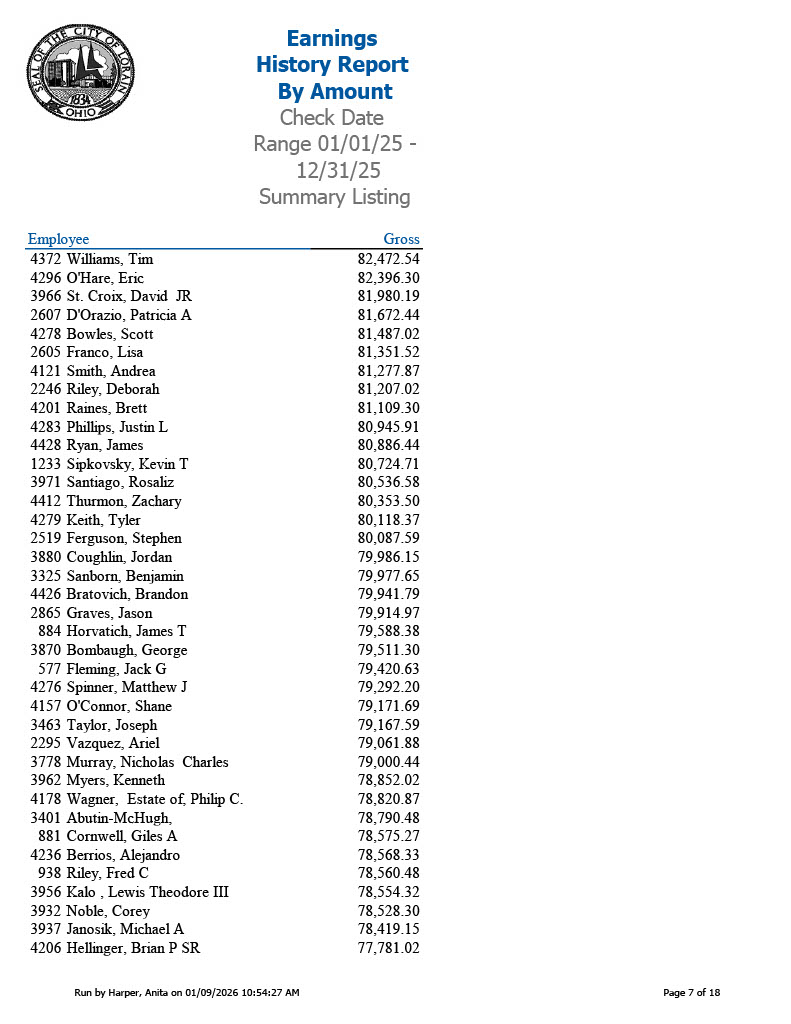

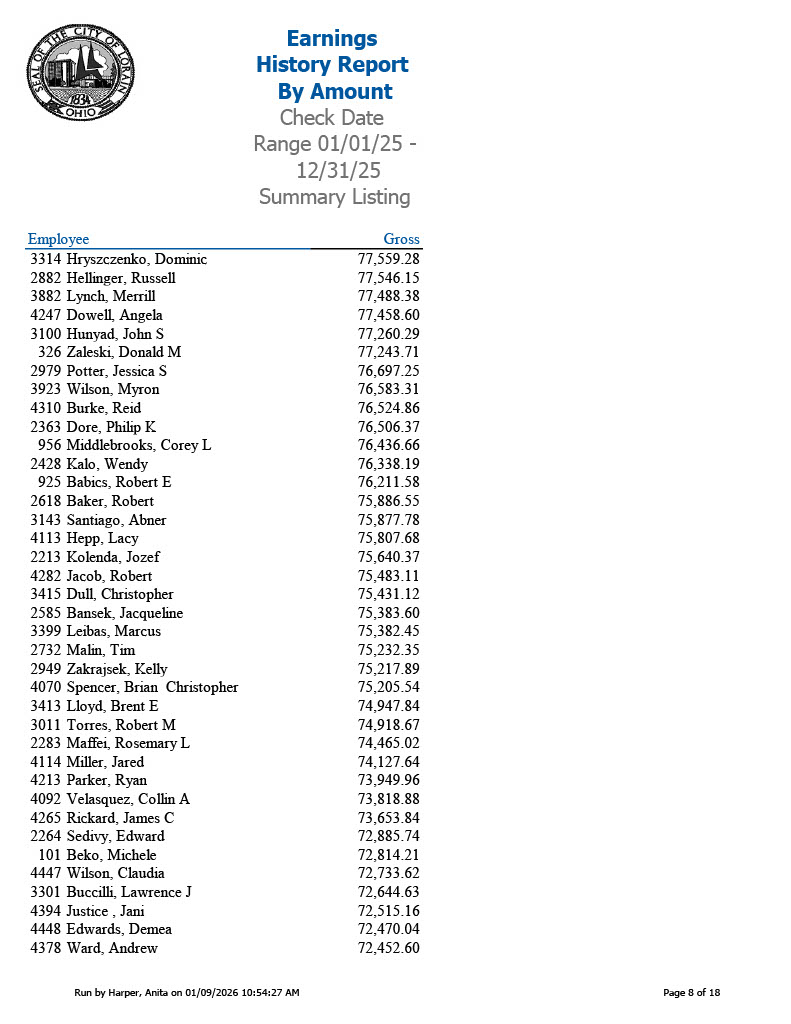

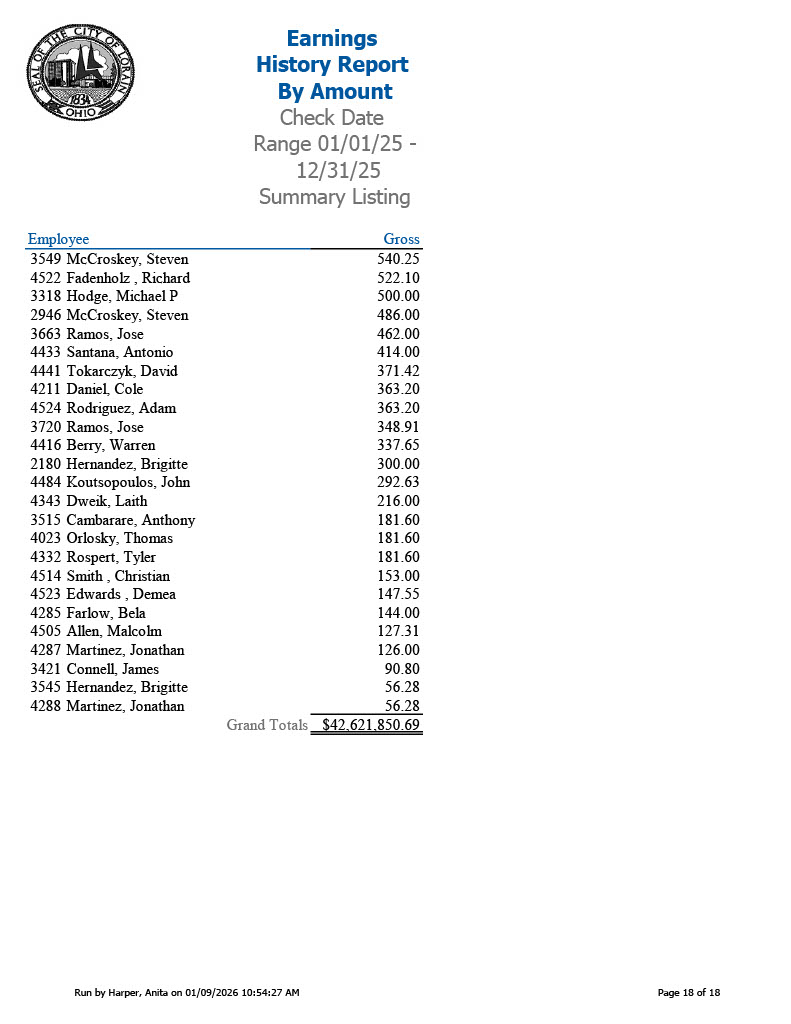

The City’s 2025 payroll output shows total gross earnings paid across departments for the year. The grand total reported is $42,621,850.69 for 01/01/25 through 12/31/25. That number is not a projection. It is not a proposal. It is not a political estimate. It is an accounting output of what was actually paid in gross earnings across the year.

See the 2025 Payroll Here: https://acrobat.adobe.com/id/urn:aaid:sc:VA6C2:e67de992-9645-4067-84d6-942b41d8a266

Now let’s be precise about what that number represents. This is gross earnings as reflected in the payroll history output. Some people use the word “payroll” to mean wages plus benefits plus employer pension contributions, and some use it to mean wages only. This article will not play that game. When I use the City’s payroll output, I am talking about gross earnings. When I reference the reporting that used “personnel costs,” I will label it as “personnel costs” because that category often includes more than gross wages.

The COVID Era Shift That Never Came Back Down

How Lorain went from the mid thirties to the low forties and stayed there

News reporting on Lorain’s budget fight documented the scale of the jump in a way the City could not comfortably ignore. The reporting stated that in 2024 Lorain’s payroll records showed approximately $42.6 million in personnel costs, compared to approximately $36 million the year before. The same coverage also quoted City Auditor Joseph Koziura warning that the City was spending more than it was making annually. That is not an activist talking. That is the auditor describing a math problem that does not care who is mayor.

Quote for the article: The City auditor warned that the City is “spending more than it’s making annually.”

Put those statements next to the City’s 2025 gross earnings total of $42,621,850.69 and the trend becomes hard to deny. Whatever happened in the post COVID period was not a temporary bump. It looks like a reset to a new floor. The City is now living at a payroll plateau that, just a few years ago, would have been treated as an emergency figure.

That matters because Lorain is not a city with endless revenue capacity. Lorain is a working city with infrastructure needs that do not pause because payroll is expensive. When payroll becomes the dominant gravitational force in the budget, every other function becomes a fight for leftovers.

Follow the Concentration, Not the Excuses

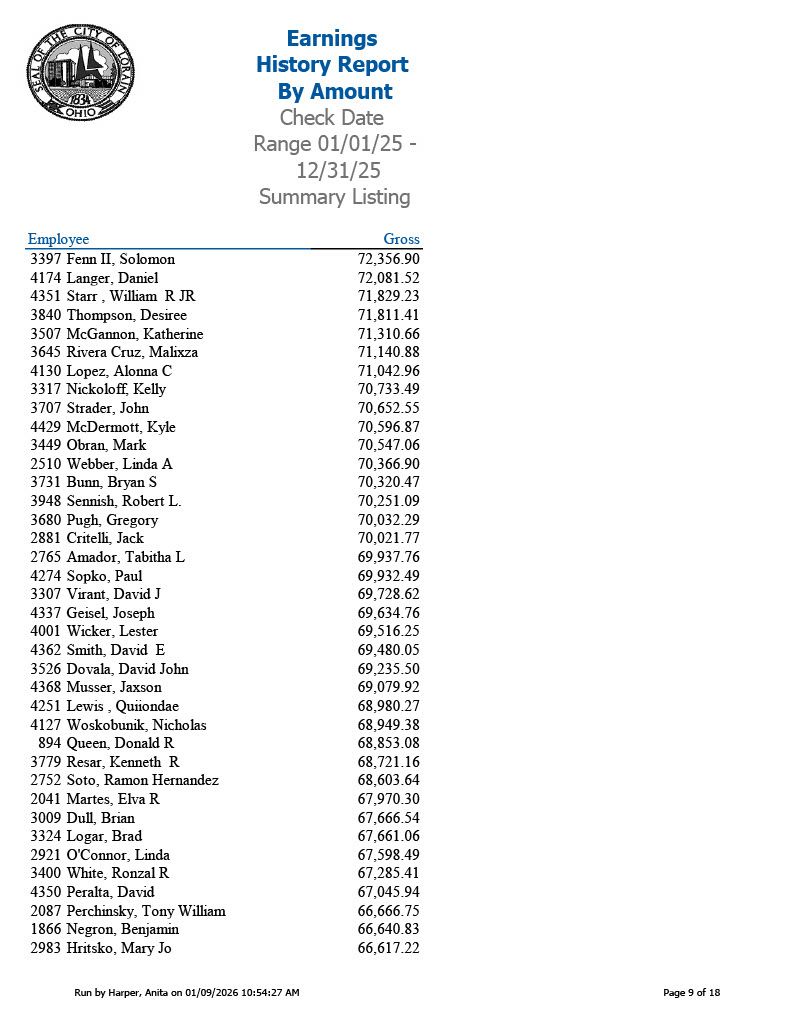

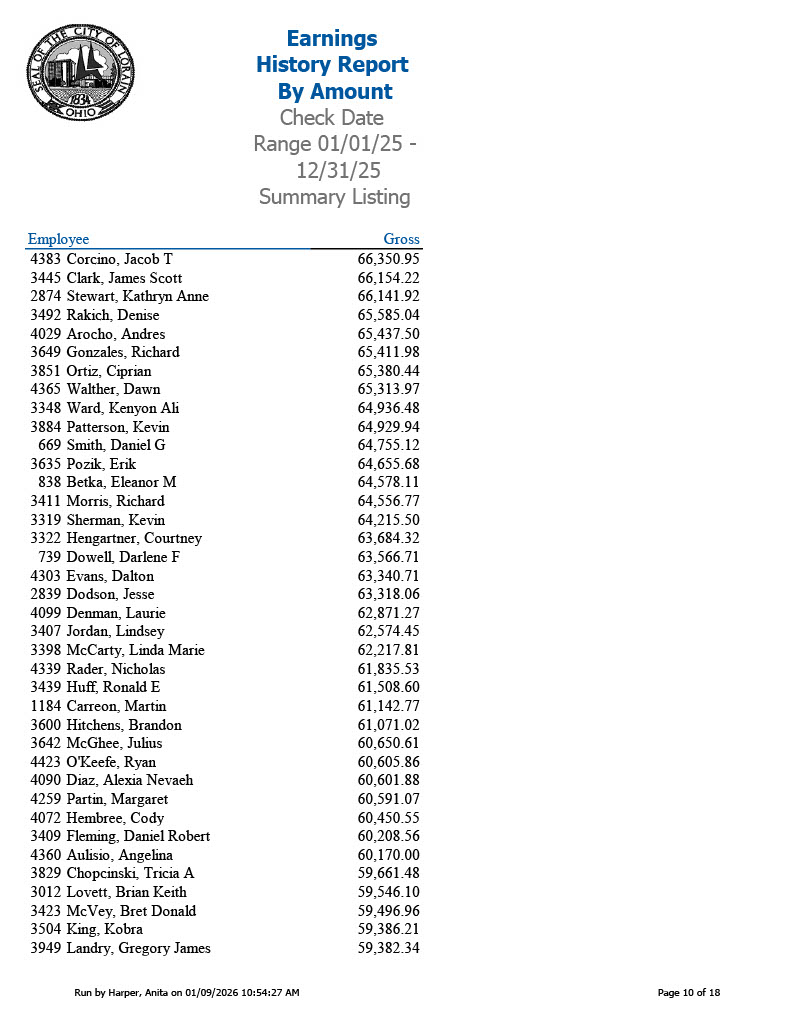

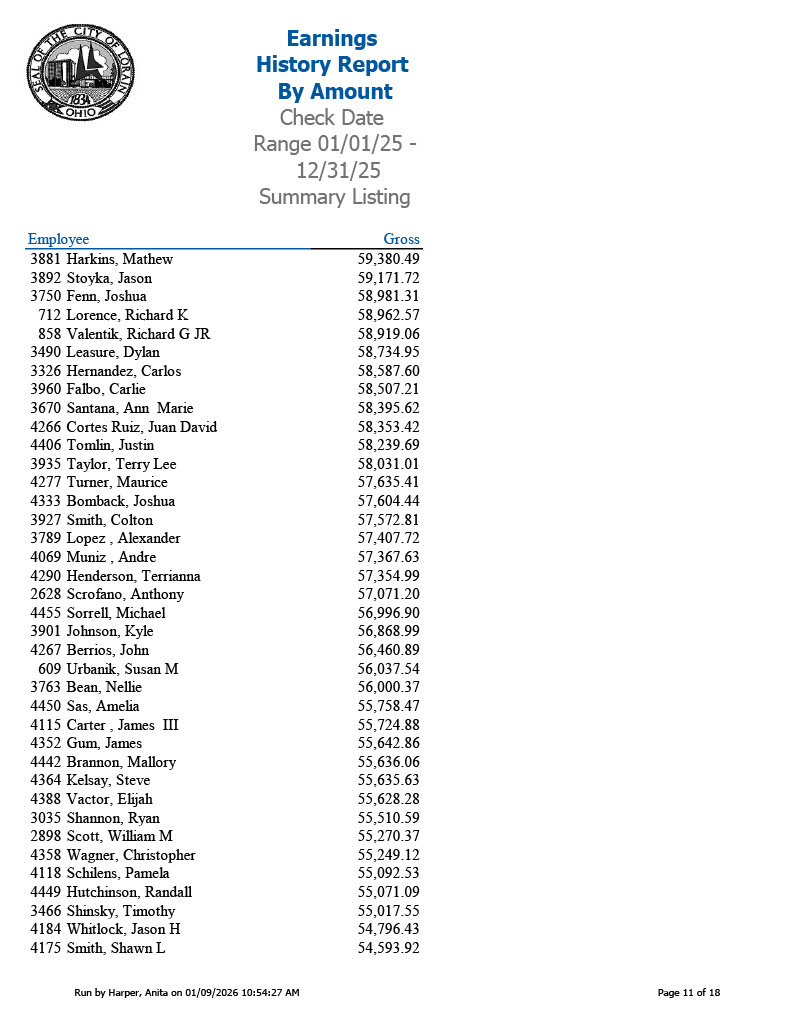

If you want to understand payroll inflation, look at where the ceiling is

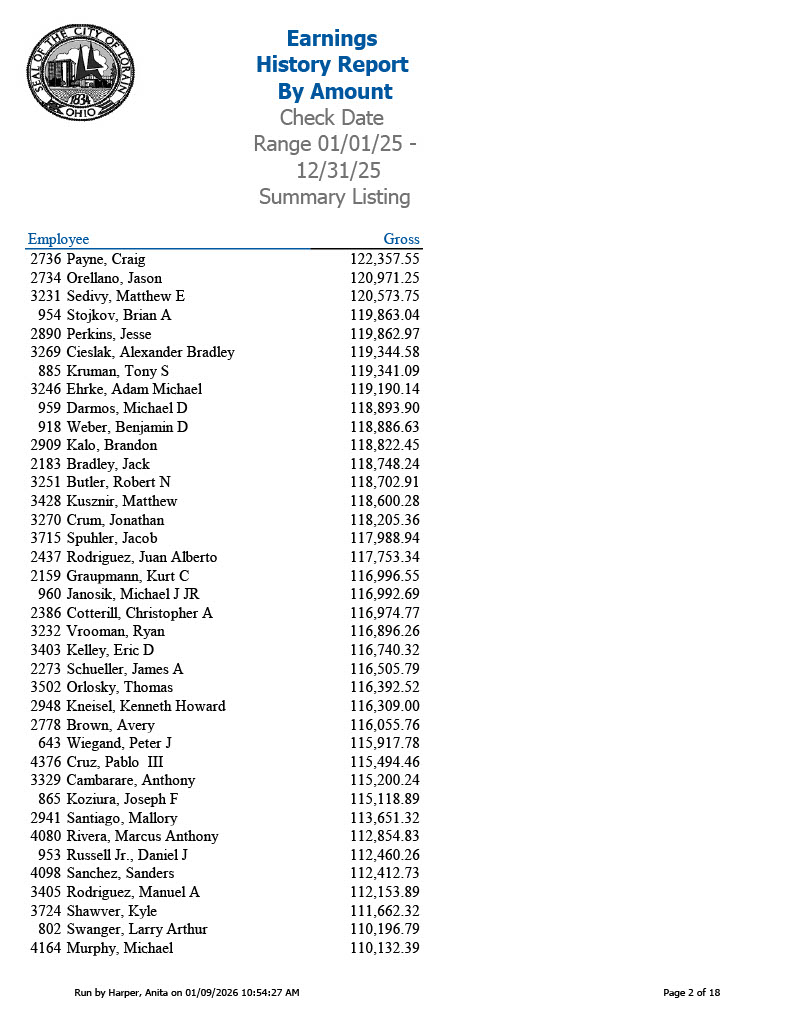

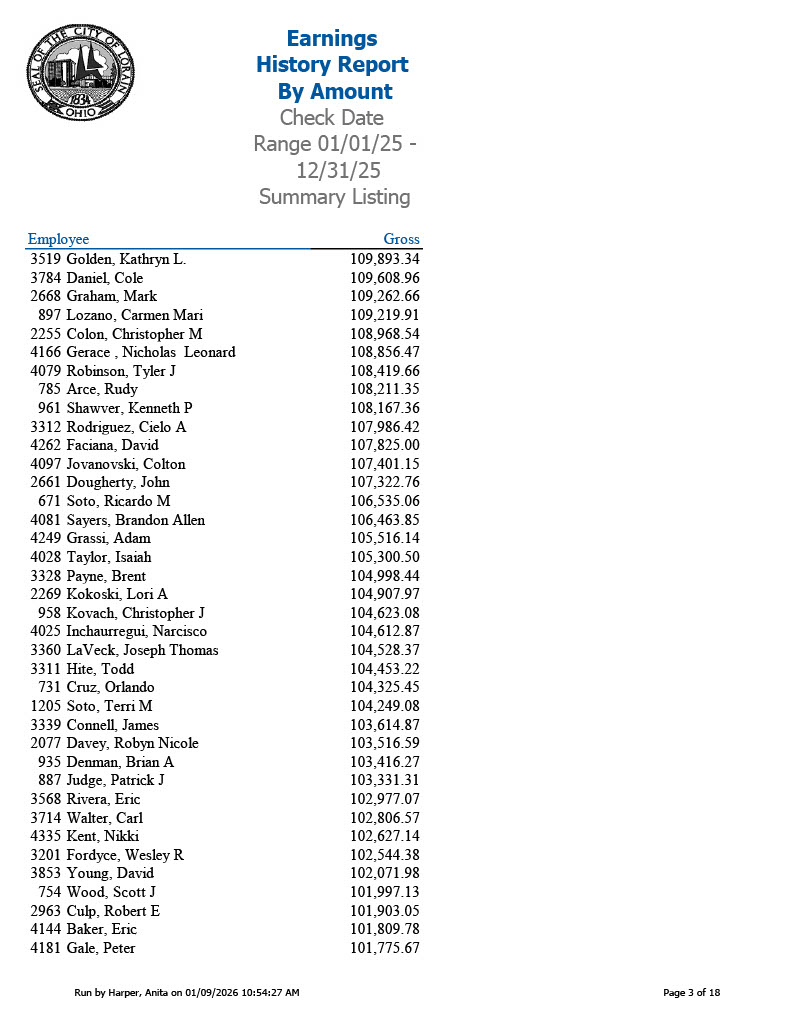

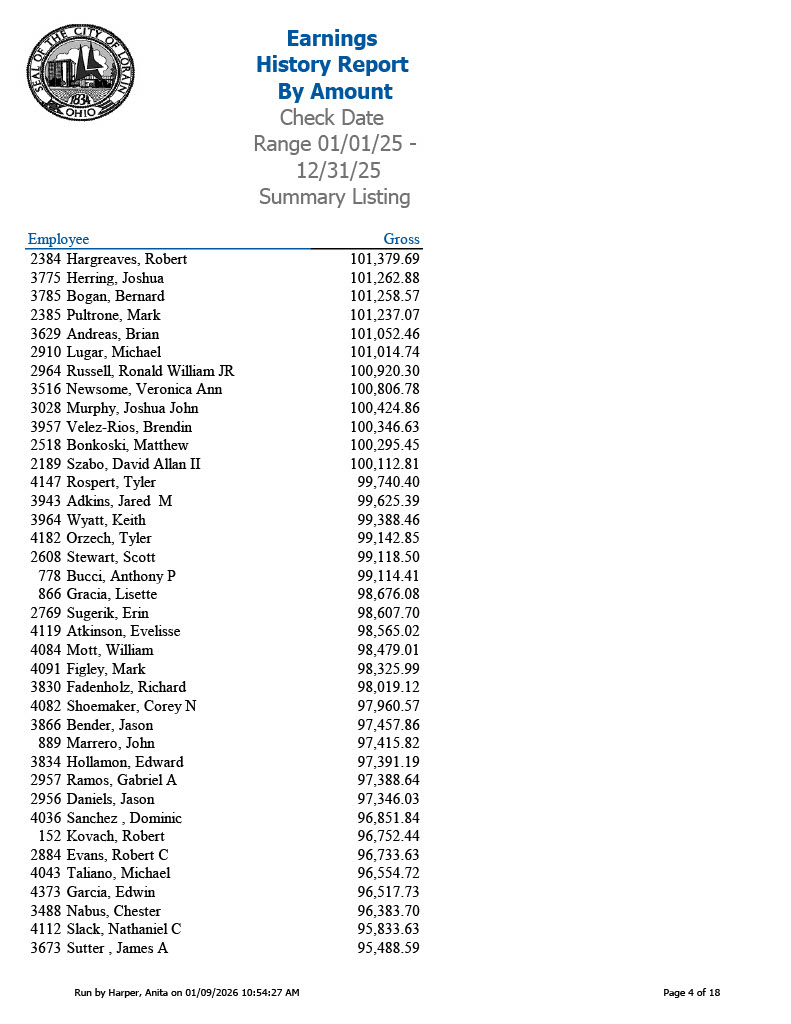

The 2025 payroll report by amount shows the distribution of earners, and it makes something obvious. The top of the payroll is not merely high. It is dramatically high for a city of Lorain’s size. The single highest gross earner listed is Police Chief James P. McCann at $270,711.44. The second listed is $210,528.10. Those are not typos. Those are the numbers on the report.

There are only a few explanations for how municipal earners reach that level. The most common is a combination of base pay plus overtime plus payouts and premium compensation mechanisms. I do not need to speculate about which component dominates because the point for taxpayers is simpler than that. When a City repeatedly produces payroll outcomes where individual totals break into that range, the City has an overtime and compensation structure problem, whether it is driven by vacancies, scheduling, staffing minimums, or a management culture that treats overtime as untouchable.

This is why residents feel the disconnect. They hear that the City cannot afford basic things, but then they read payroll totals that look like the private sector executive tier. They hear that the City is struggling, but they watch the payroll ceiling rise.

Public Safety Is the Center of the Payroll Universe

What the state forecast shows about police and fire wages and benefits during the COVID and post COVID years

The Ohio Auditor of State forecast provides another angle, because it breaks out police and fire wages and benefits across multiple years. In 2020, the forecast shows police wages and benefits at $12,655,945, then $12,706,639 in 2021, then $13,130,527 in 2022. For fire, it shows $8,006,418 in 2020, then $8,901,932 in 2021, then $9,233,497 in 2022.

Those are the COVID and immediate post COVID years. Even there, the direction is upward. Then the same forecast projects police wages and benefits reaching $15,120,049 in 2025 and fire wages and benefits reaching $10,307,398 in 2025. Again, a forecast is not a check register, but the value of the forecast is that it shows the trend line that the City is expected to live with if it does not change structure.

The big point is this. When the two largest, most expensive, most politically protected departments grow year over year, the rest of the budget becomes a sacrifice zone. In Lorain, that is not a theory. It is how the math works.

The Quiet Part Nobody Wants to Say Out Loud

When payroll becomes the budget, the city starts living off deferment

There is a pattern that shows up in cities that reach this stage. They do not “go bankrupt” overnight. They just start deferring everything. They defer equipment replacement. They defer street programs. They defer building maintenance. They defer staffing in smaller departments. They defer technology upgrades that would make government efficient. They defer training. They defer inspections. Then they blame the public for expecting too much.

Payroll does not merely consume money. It consumes flexibility. And once flexibility is gone, every emergency becomes an argument for new taxes or new levies, because the budget no longer has room to absorb shocks.

If a city wants to defend a high payroll structure, it must be willing to show the public the outputs that justify it. Not slogans, outputs. Response time improvements. Clearance rates. Staffing stability without burnout. Reduced liability exposure. Reduced overtime dependency. Reduced turnover. Improved service metrics. If the City cannot show that, then payroll is not an investment. It is an uncontrolled recurring obligation.

What Lorain’s Own Payroll Output Shows About “Small” Departments

This is not a story about council salaries or clerks

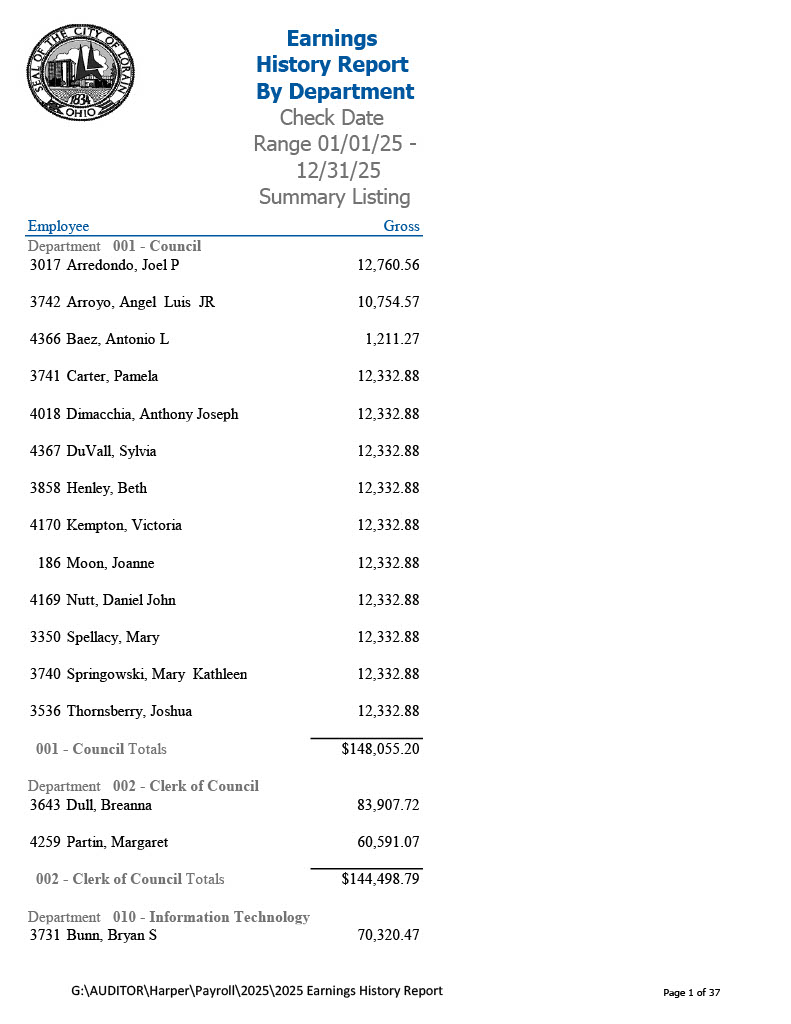

Here is where people waste time. They get mad at the smallest line items because those are the easiest targets. The 2025 department output shows City Council at $148,055.20 for the year. The Mayor’s Office is under two hundred thousand. Those are not the numbers driving the structural pressure.

The structural pressure comes from the departments that can produce premium pay outcomes, overtime outcomes, and large headcount costs. The City can fight about symbolic cuts all day, but the payroll record makes clear that the real money is concentrated elsewhere.

That is why residents are right to focus on overtime, staffing models, and contract structures. That is where the system is either disciplined or it is not.

The Quote That Explains the Whole Fight

Overtime and retroactive pay are not a theory, they were cited as drivers

The reporting on the 2024 payroll spike included the Mayor attributing the large number to overtime and a retroactive pay increase connected to contract negotiations. That is important because it confirms what the payroll distribution implies. A system that relies on overtime, combined with retroactive wage adjustments, will create a spike that looks like a cliff, and then it will likely normalize at a higher floor because base wages remain elevated even after the retroactive part is paid out.

In plain English, Lorain did not just “have a bad year.” Lorain may have structurally raised its recurring costs, and now it has to live inside that decision.

What Comparisons Should Actually Do

Not a contest, a diagnostic

Comparing Lorain to other cities and to Lorain County is not about humiliation or bragging rights. It is about diagnosing whether Lorain is behaving like a typical mid sized Ohio government or whether it has drifted into outlier behavior. The most honest comparisons are not just totals, but ratios and distributions. How many six figure earners exist as a percentage of headcount. How much overtime exists per employee. How much of the general fund is consumed by personnel. How fast wages and benefits are growing relative to revenue growth.

In the next part of this series, I am going to do what the City will not do in public. I am going to use the payroll outputs to build a map of concentration, showing where the money pools, how heavy the top end is, and what departments have the largest footprint relative to their service outputs. That is not anti employee. That is pro taxpayer accountability.

Reader Roadmap and Document Drop Points

How I want you to verify this for yourself

I do not want readers taking my word for anything. I want readers looking at the payroll output themselves, because once you see the numbers, you cannot unsee them. This is the part of the article where you should embed the source documents and also provide a simple graphic for people who will not read PDFs.

Final Thought

Payroll is not just a cost, it is a promise the city makes every year

The City can treat this like a political argument if it wants. It can say critics hate public employees. It can say residents do not understand budgets. It can say the economy is complicated. But payroll is not complicated. Payroll is a promise. It is the City saying, “We will commit this amount again next year,” because once you raise the floor, you do not easily lower it without layoffs, service cuts, or a political war with unions.

If Lorain’s payroll has reset into the low forty millions after COVID, then Lorain needs to have an adult conversation about what revenue supports that, what services it will sacrifice to protect it, and what accountability metrics justify it. If it refuses, then the City is not managing a budget. It is managing a narrative, and narratives do not pay bills.

Disclosure and standards statement: This article is an analysis based on payroll outputs, publicly reported budget figures, and state produced fiscal forecasting documents. It is not legal advice. It does not allege criminal conduct. It does not assign legal liability. It makes a narrow claim. The payroll totals and the post COVID jump are documented, the concentration among high earners is documented, and the sustainability warning was made on the record by the City auditor.

2 thoughts on “The Payroll That Ate the Budget”